|

From the Share Wealth Systems R&D Team |

_

Know the system

Before starting to improve SPA3, we needed to know a whole lot of metrics about the system as it stands. All trading systems based on technical analysis criteria will have a set of price action patterns or indicator criteria to be met to signal an entry or exit, SPA3 included. The price action pattern or indicator values will be determined by the relative position of the current price action to past price action. This is important when designing or changing signal criteria, but to have the data required to know what to change and why, the system designer needs to “know the system.”

When getting to “know your system” a change in paradigm is required. The designer needs to know the characteristics of the trades that ensue from the entry and exit criteria. To do this, all trades need to be viewed as starting from 0% profit and day 0 rather than in the context of price action leading into the trade.

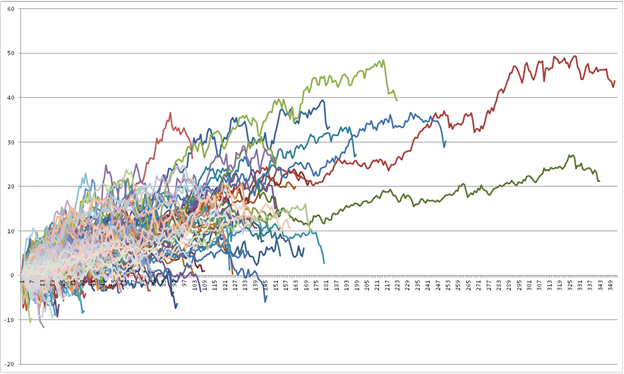

The diagram below is an example of many different trades over a multiple year timeframe that resulted from a particular trading system, without any risk or money management applied. This is called a straw-broom graph.

Click the link below to view a presentation by Gary Stone on the above straw-broom graph.

Click to play – Know Your System 1

Note the following:

1. Every trade is unique.

2. Every trade is a different length.

3. Some trades start out as losses and remain losses.

4. Some trades start out as winners and remain winners.

5. Some trades start out as losers (winners) and end up winners (losers).

6. The slopes of the trades are different.

7. The resultant closed trade profit varies across all trades.

8. There is an “average” slope and an “average” length and an “average” profit that can be visually determined from the diagram that would be different if viewing a similar set of trades from a different trading system.

When getting to “know your system”, all of these characteristics can be expressed in numbers, more specifically, statistical numbers of particular metrics. As shown in the diagram below, each trade may have a Start Trade Drawdown (STD) but will have a Maximum Adverse Excursion (MAE), a Maximum Favourable Excursion (MFE), an End of Trade Drawdown (ETD) and a Closed Trade Profit, as shown below. The MFE is also called the maximum open trade (or unrealized) profit.

Click the link below to view a presentation by Gary Stone on the above diagram.

Click to play – Know Your System 2

The MAE and STD could be 0% if the trade rises immediately and never falls below its entry price. The MFE could be 0% if the trade immediately falls and never rises above its entry price. There will always be an ETD > 0% unless the MAE and MFE are also both 0% which is a very low probability event when trading liquid instruments.

Whilst minimising the MAE and maximising the MFE might seem obvious objectives, this is largely controlled by the randomness of the price movement in the instruments being traded while the trade is open, in the timeframe that the system is attempting to capture profits. The obvious way to increase MFE is to allow the trade to remain open longer, i.e. increase the timeframe for the system. The obvious way to decrease the MAE is to cut the time that a trade is open. Yet another paradox in trading!

As described above, one of the two key metrics that has been targeted to be improved to achieve the stated objective of this revision project is to reduce the End of Trade Drawdown. This means to reduce the distance between MFE and Closed Trade Profit.

Next time I’m going to discuss the “Consequences of reducing end of trade drawdown and increasing the win rate”.

If you are interested in learning more about the groundbreaking Research and how the SPA3 system can help your investing – Register for an obligation free demonstration