For decades BHP has been the “big Australian” being the country’s largest market capitalised stock. But every now and then it gets knocked off its perch as it has been in the past by Telstra and currently by CBA. BHP is currently capitalised at A$121.4 billion on the ASX compared to CBA clocking in at A$130.7 billion.

Since mid-April 2011 BHP’s share price has dropped from a high of $49.81 to $37.80, a decline of 24.1%, as CBA’s share price has risen over the same period from $52.92 to $80.61, a rise of 52.3%, excluding dividends, allowing CBA to become Australia’s largest company by market capitalisation. What are the chances of the “big Australian” reclaiming its number one seeding?

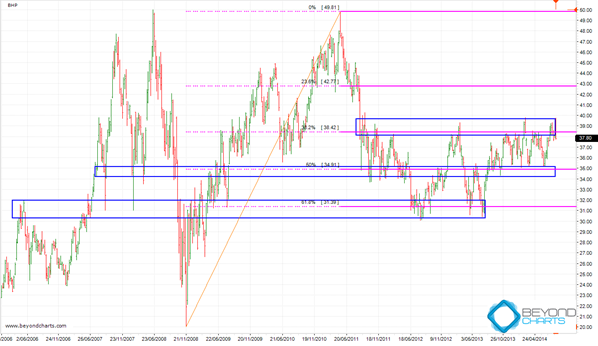

BHP Chart

The weekly chart below shows that the BHP share price has been stuck in a range between $30 and $40 for the last three years since August 2011.

The upper and lower zones of the range are shown below by the upper and lower blue rectangles. A support zone has also formed around the mid-point of the range shown by the middle blue rectangle

The horizontal magenta lines are Fibonacci retracement levels which coincide with the blue rectangle support and resistance zones and are themselves great indicators of support and resistance levels.

Source: Beyond Charts

Technically, for BHP’s share price to rise to previous levels of around $50 and maybe beyond, it needs to have a clear break above $40 as a first step. It is obvious from the above chart that numerous attempts have been made in the last eighteen months, in vain.

In the short term the odds are that BHP will retrace back to the middle support zone and Fibonacci 50% retracement area of around the $35 mark.

Commodities prices and recent company announcements

So what may it take for BHP to break out above $40?

Firstly, recent announcements of a demerger to create a separate global metals and mining company may be a catalyst to energise such a breakout. It could however also have the opposite effect depending on how investors digest what the demerger will actually mean.

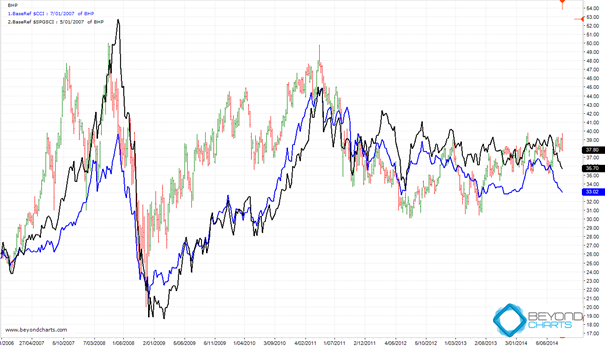

Secondly, a rally in metals prices may be the impetus required to fuel a BHP breakout above $40. In the chart below the Continuous Commodities Index and the S&PGS Commodities Index have both been overlaid on the BHP weekly chart with a common relative base as at January 2007.

These two commodities indices are calculated slightly differently hence their different magnitude in price movement however their shape and direction over the last 7.5 years are very similar. The key conclusion from this chart is the high correlation that the BHP share price has to these two commodity indices.

Source: Beyond Charts

The question begs whether the BHP price will be able to rally without a rally in these commodity indices which will need metals and or oil prices to start rising, the odds of which appear low in current global economic conditions.

Also, how might the market view the demerger entity compared to the remaining BHP entity in the light of this high correlation to the commodity indices?

Another factor in this correlation is that iron ore is not included in either of these commodity indices. As iron ore will remain in the core BHP Billiton entity maybe the decoupling of BHP Billiton from its ‘metals and mining’ assets can have the necessary effect for a rise in the BHP Billiton share price. But what then of the demerged entity which will most likely continue to have a high correlation to the commodities indices?

In the short term, with the uncertainty of the demerger and the high correlation to commodities prices, it appears that there is a low probability of the combined BHP Billiton share price reclaiming the number one seeding. Unless of course CBA’s fortunes change for the negative but there seems to be a low probability of that occurring too.

2 Responses

Pity as I bought BHP following an Intellegence accumulate signal on 17th July. Who is right?

Response to Comment by Bill:

Intelledgence provided the Accumulate signal based on the objective analysis of price action to that point in time by a mechanical system that has a statistical edge over a large sample.

Whereas my analysis, written for a 3rd party newsletter and re-published on this Journal a few days later, was done based on a request to analyse BHP and on my subjective analysis of price and consideration of ‘information’ that may be determined as “noise” to a mechanical system.

Which is “right” will only be known with the benefit of hindsight and will most probably be due to variables and factors unknown at that time and even at this time. Which is why an objective exit mechanism, based on the net effect of all variables and which is ultimately reflected in price action, is so important.

As you well know, that’s the reality of investing.

Regards

Gary