This was the front page of the AFR WEEKEND last weekend on 2nd May.

Whilst this attention grabbing headline is a very important question, I think that a far more important question that needs to be asked by the vast majority of Australian investors is “How can I maximise my chances of reaching the “new golden number?”

The simple answer is: do not rely on investing your retirement monies with Super Funds. This can, and will cost you 100’s of 1000’s of dollars over a life time of investing. A far better choice is to “Do it Yourself”.

“But I don’t have the time to learn and do it myself!” I hear you exclaiming.

This is exactly the type of response that fund managers want to and love to hear.

My response is always a rhetorical question: “how many hundreds of thousands of dollars difference will it take to make you lose the attitude of apathy and take responsibility for the investment performance your money?”

Here are two simple do-it-yourself investing methods that will put you way ahead of where you might have been if you continue to abdicate responsibility for your money to the so called ‘professional fund managers’:

- Buy and hold the ASX200 via the STW Exchange Traded Fund (ETF) and re-invest all dividends. The ASX 50 and ASX20 are also alternative ETFs that could be considered.

- Put a bit of extra effort into removing the possibility of your funds being subjected to a 2008 type bear market. (When the ASX200 fell by 55%!).

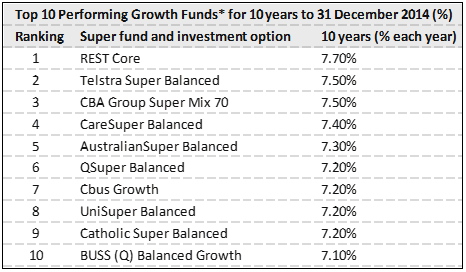

To put this into perspective and compare performance, let’s take a look at the best performing managed super funds in Australia over the past 10 years.

QSuper Balanced was the best performing Super Fund in calendar year 2014 against every other Super Fund in Australia including active Super Funds, Corporate Super Funds and Industry Super Funds that meet a minimum requirement (Source: CHANT West 20 January 2015 media release).

It was also placed 6th over the 10 years to 31st December 2014 against all-comers in the Super Fund industry that meet a minimum requirement (Source: CHANT West 20 January 2015 media release) . REST Core was the best performing Australian Super Fund over this 10 year period returning, on average, 7.70% compounded each year BEFORE admin fees and adviser commissions!

“*Performance is net of investment fees and taxes. The returns in the table are before any administration fees or adviser commissions are deducted. The performance data is based on Chant West figures, and the table ranking is based on individual investment options offered by a superannuation fund, and the investment options involved in the ranking process look after assets worth $1 billion or more.”

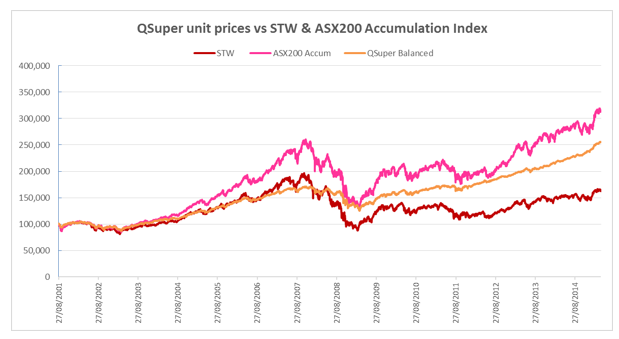

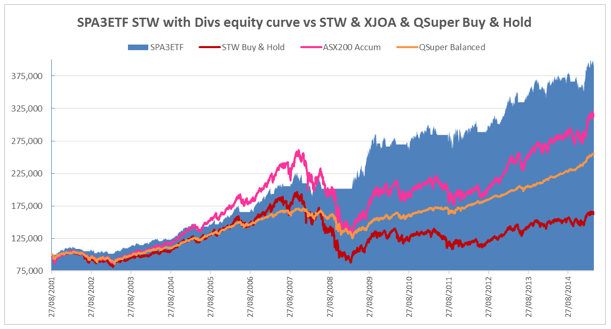

Here is a graph that compares the performance of the QSuper Balanced fund with that of the ASX200 Accumulation Index and the STW Exchange Traded Fund (ETF).

It can be clearly seen that the best-performing Superfund in 2014, the orange line in the middle, considerably underperformed the ASX200 Accumulation Index, the pink line at the top, over the period shown. The STW chart, the bottom brown line, does not include dividends.

It can be clearly seen that the best-performing Superfund in 2014, the orange line in the middle, considerably underperformed the ASX200 Accumulation Index, the pink line at the top, over the period shown. The STW chart, the bottom brown line, does not include dividends.

This chart covers the 13.65 year period since STW was listed in August 2001 to April 2015.

The first method mentioned above where you buy and hold the STW, then re-invest the dividends, will achieve similar results to the ASX200 Accumulation index.

All investors should, at the very least, do this.

Stop paying your dollars to the industry “professionals” to underperform the benchmarks. Stop handing over your Super contributions to pay massive salaries to investment managers, commission to sales people, and fees to advertising agencies to spoon feed advertising rubbish right back at you about how well they perform because they have less fees!

The point is that they have fees, they eat into YOUR retirement money and they underperform over the long term.

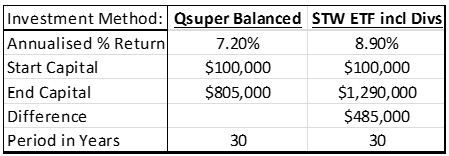

Let’s take a look at some numbers. A buy and hold investment in the ASX200 with reinvesting dividends over a 30 year period at the same annualised return achieved over the last 13.65 years would produce an annualised gain of 8.90% and grow $100,000 to $1,290,000.

This is 1.7% better per year than the best performing managed super fund of 2014, if it achieved 7.2% over the 13.65 years. As can be seen in the table below, this could make a difference of $485,000.00 to YOUR retirement funds.

Yes, a miserly 1.7% per annum of compounded growth over 30 years = $485,000.00 when starting with $100,000.

This excludes ongoing super contributions over the 30 years.

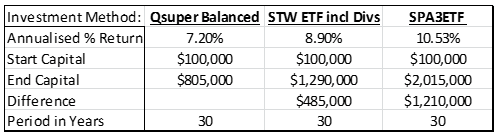

The third column in the table below shows what could potentially be achieved by the second method mentioned above, with a bit more effort to avoid a 2008 type bear market in the future of a 55% fall in the market.

Using the SPA3ETF methodology to trade, on average, 2.2 times per year over the 30 year period could result in a 10.53% annualised gain. This 3.3% per annum difference would result in an extra $1.21 million in your retirement funds and would massively increase your chances of reaching the Fin Review’s “new golden number”.

Using the SPA3ETF method to actively invest in the STW ETF can achieve the performance indicated by the blue shaded area in the graph below. The chart clearly displays the outperformance of this method when compared to a buy and hold strategy of the STW, the ASX 200 Accumulation Index (= STW with dividends), and the best performing managed Superannuation fund of 2014.

Sure this may be academic because nobody knows what the future holds and the AFR article was about preparing for lower returns on the way to the golden number. But there are some principles at play here. Handing over your money to the investment managers is NOT the highest probability way of accumulating wealth. The 1% – 3% compounded growth that they take in fees and commissions will leave you with much, much less in retirement.

When the Super funds in Australia started there wasn’t an instrument such as an ETF with low investment costs and index-type performance. Now there is and it’s high time that more time poor investors cottoned on to them and made the change right away.

Trying to select stocks and manage a portfolio of many stocks is not necessary any longer. A stock portfolio approach could do better but requires far more time and effort. As shown above, the use of the SPA3ETF methodology to actively invest in the STW ETF, trading on average 2.2 times per year, can achieve well above average returns and make a significant contribution to the amount of money you will have to fund your retirement.

Past performance doesn’t guarantee future performance. But it does raise the probabilities of doing way better than you otherwise might have!!

What about a plan for the Baby boomers who still need topping up and have maybe 10-15 years before they fall off the tree?

David,

The strategy is the same. Avoiding a large bear market becomes even more important.

However, maybe some of the dividend stream may need to be drawn down. This depends on the size of capital being managed, amongst other things.

Regards

Gary

Have you compared apples with apples? ie super funds have paid tax and accountant + auditor fees, ASIC compliance, etc…

In your comparison have you accounted for deductions in super admin costs that SPA3ETF via SMSF would have to pay over the 30 years. Most accountants charge $2,000 +GST for compliance and tax returns + possible tax on returns and CGT when you sell at the top of the market and go to cash!

please comment as I find these types of comparisons like yours very basic and mostly misleading!

Marc,

Your point about comparing apples with apples is a good one. Super funds make it very difficult to do so by bundling costs. And even if they didn’t it would still be difficult to do a 100% apples on apples comparison.

What we need to do though is ensure that we can identify ALL the costs. With managed super funds and managed funds it is difficult to do this. With SMSF’s far easier.

Let’s cover the SMSF admin costs first. Many of our customers use a company that does SMSF tax returns AND SMSF audits for a combined annual price of $699. That’s it. They are not the only company down at these price levels or not much more.

Then there would be brokerage costs. Using ETFs at 2.2 trades (x2 for transactions) brokerage would be around $180 and with a US broker around $45 per annum. Just buying and holding the STW and re-investing dividends would be $0 in brokerage in the above comparisons.

The tax to be paid by the SMSF is on profit when an asset is sold (CGT and income are treated the same in an SMSF in accumulation phase I believe) which may be eliminated by buying and holding the STW, reinvesting all dividends and never selling until the SMSF goes into ‘retirement’ phase and thereby never paying ‘CGT’. For the purposes of the comparison above this would probably be far less tax than managed Super funds.

In the case of timing with SPA3ETF where a sale is made and hence a ‘profit’ event occurs, a maximum of 15% tax on total profit per annum in the SMSF may be due, but would be less as there would be some deductable costs.

In the case of a managed Super fund CGT may be included in the unit price although it is seldom disclosed on member statements so how much the unit price is adjusted for you as a member to account for CGT is very difficult to calculate.

Contributions tax would also be paid in both scenarios but contributions are not included in the above comparisons. This is typically shown in detail on a Super fund members statement. So there is an apples on apples comparison in this area.

Onto the managed Super fund costs. The above Super fund returns in the Chant West table admin fees are EXCLUDED. And advisor commissions, if applicable. They could also exclude the ORFR Levy and other “indirect” costs that Super fund managers ‘deduct’ by changing the unit price at which you are allocated new units, which are not openly disclosed so you don’t really know.

My point is that it is very difficult to determine what the actual costs are that a member of a managed Super fund might pay and therefore it is unlikely that the above returns in the Chant West include ALL the costs that an individual member actually pays.

In fact during the Financial System Inquiry in 2014 some of the super ratings companies requested that managed Super funds make their fee disclosure more transparent.

The point is that the great majority of active Super fund and fund managers still underperform the Accumulation and Total Return indices.

I trust that this assists.

Regards

Gary

There’s also the data and maintenance fees for using SPA3ETF which is another cost for the SMSF. This is around 1% for a 100K portfolio.

Gary I pay more than the stated amount for my audit alone, than many of your other customers pay for tax as well as audit. Are you able to let me in on this information.

esuperfund.com.auJennifer,

One is http://www.esuperfund.com.au but there are others. I haven’t done the research for a while but it won’t take long to find others.

Regards

Gary

Ern,

This is correct.

The SPA3ETF data & maintenance costs, being a flat fee-for-service cost, doesn’t continue to scale for larger portfolios as percentage fees do for managed Super funds and as trailing fees do for active managed funds.

The scenario that I provided above is just one of the SPA3ETF strategies being the “timing a single ETF strategy”.

Other researched strategies that are provided with SPA3ETF performed better in detailed research than this strategy thereby providing further profit to cover the flat fee non-scaling costs.

Firstly, the same strategy as discussed above can be executed with the same levels of leverage that Warren Buffett is reported to use and add another 3.57% compounded per annum.

Secondly, this same strategy, unleveraged or leveraged, can be conducted on single off shore index ETFs that have performed far better than the example discussed in the blog. The example in the blog is the ASX200 STW ETF. Historically the ASX200 has underperformed off shore indices such as the S&P400 Mid Cap, NASDQ100 and others.

Thirdly, there is a relative strength SPA3ETF strategy that not only times a selection of off shore ETFs but also ensures that ones investment capital is in the best performing index ETF at any given time.

Fourthly, there is yet another SPA3ETF strategy that allows the investor to focus on a select number of ETFs and diversifies equally across those ETFs, leveraged or unleveraged.

Both these latter two strategies performed far better over the last 15 years than the scenario discussed above with the STW, or with a single main off shore index ETF, thereby allowing even more room to cover flat fee costs and tax. It was possible to achieve over 20% compounded per annum with volatility of the around the same as the Super funds before these costs and SMSF tax at a maximum of 15% p.a.

Lastly, the ‘free’ strategy of buying & holding the STW (never selling with no timing) and re-investing all dividends has no additional data & maintenance costs or ‘CGT’ tax (if held into an SMSF’s retirement phase) and over the long term smashes the best performing Super funds. The longer the term and the more capital invested the more 100s of 1000s of dollars, or even millions, the difference will be. (This strategy shouldn’t be leveraged.)

Remember too that many people are NOT in the top 10 Super funds and the funds that are the best now won’t necessarily be the best in the future.

Based on performance over the last 35 years in the USA and over the last 20 in Australia, there is an extremely high probability that NO Australian Super funds will outperform the STW + re-invested dividends held until an SMSF reaches retirement phase.

Regards

Gary

QSuper Balanced has an average allocation to equities of just 34% whereas the XAOA and STW are 100% mandated to equities.

Also, the STW data in the equity curve above excludes dividends. From a list price of $18.45 through today @ 8.9% places it above the 2007 highs.

Nick,

Indeed QSuper balanced has a lower allocation to equities as does just about every managed Super fund. The point is that the Super fund member gets this allocation whether they like it or not. And they get the associated returns and volatility (and drawdown) which are all lower.

I chose QSuper for the comparison purely because it was the best performing managed Super fund in 2014, being the latest data, and it did well over the last 10 years too coming in 6th.

The blog does say that STW excludes dividends. In the blog the ASX200 Accumulation index (XJOA) is used as a proxy for the STW + dividends. Indeed the XJOA is now higher than the 2007 high, as the magenta line in the chart above shows.

Regards

Gary

Gary you mention in one of the comments above the “single off shore index ETFs that have performed……. being the ASX200 STW ETF” Pehaps I am missing something (it’s been done before) are you saying that the STW ETF is an off shore index? you see I am thinking of just taking on the Australian ETFs for simplicity sake, and this if is better as an off shore index then I am certainly missing something.

Jennifer,

The STW ETF is definitely not an off-shore index ETF! It tracks the ASX200.

There may have been some ambiguity in my statement. The “being” qualified the last referenced subject in the sentence being the ASX200. The “being” could have been misinterpreted to qualify a single off shore ETF.

I have amended the para above to remove any ambiguity.

Regards

Gary

Gary

I have a few questions:

– I assume the SPA3 system generates entry and exit signals- does it also incorporate a market filter to keep you out of all trades in a particular market during a downturn?

– having regard to liquidity in ETF markets, what [maximum] size holding in a single transaction can realistically be made in say the STW, ASX50 or say the S&P500? Is the sell side of the ledger synthetically supported by the issuer, like Warrants for example, so that bids can be absorbed around a given level, or is it purely market driven?

I ask because I am interested, but only if I can readily buy the size parcel I am after.

Thanks

PS: I should add in the final sentence “readily buy and sell”

JohnMc,

Our SPA3 equities system for the ASX and NASDAQ certainly does have filters:

1. Firstly, at an overall market level which we call Market Risk. When Market Risk is High, as determined by Timing on the relevant index, then the investor should go 100% into cash.

2. Secondly, at a stock level where each stock is measured using relative strength against the relevant market index to determine whether the stock is outperforming the index or not. If not, then the stock is not considered for purchase. If it is, only then can a technical entry occur into the stock.

For our SPA3ETF system, at any given time for any given ETF that the investor may wish to invest in, the investor will either be in the ETF or in cash using technically researched entry and exit signals.

The STW has been averaging between $5M & $8M a day for around 18 months but in 2009 – 2012 averaged between $10M – $20m a day.

However, the main indication of liquidity for an index ETF is the total liquidity of the constituents in its underlying index, which is the ASX200 in this case. As you would know this is in the low billions a day.

The S&P500 has multiple ETFs (as does the ASX200), the largest of which by liquidity is the SPY. This ETF averages between $15B – $40B a day but could trade more if there was more demand, the total liquidity pool being all the constituents of the S&P500.

Whilst an ETF spread is provided by a market maker, my view is that it is not the same as a market maker in a purely sell side instrument such as an equity warrant.

The spread for an ETF is definitely more market driven. There is a lot of competition between ETF providers to minimise costs & fees wherever they can for their clients. It is their main product differentiation to unlisted active funds.

Trust that this helps.

Regards

Gary