This week I would like to take a look at the close relationship between what we can call the ‘hard’ commodities and the Australian share market. Hard commodities include resources like gold, silver, oil, copper, nickel, iron ore, and coal. They are generally mined or extracted, as opposed to the ‘soft’ commodities which include grains, cotton, lumber and other food or feed products which are generally grown to be harvested for human or animal consumption.

The prices of these hard commodities have a huge influence on the overall performance of the Australian share market. For example there are 506 stocks listed on the ASX as Diversified Metals & Mining, 274 stocks listed as having exposure to Gold, 173 stocks that make up the Oil & Gas Exploration & Production sub industry group and 128 Coal and Consumable Fuels stocks. These stocks plus many others in other resource bound industry groups all fall under the Energy and Materials sectors.

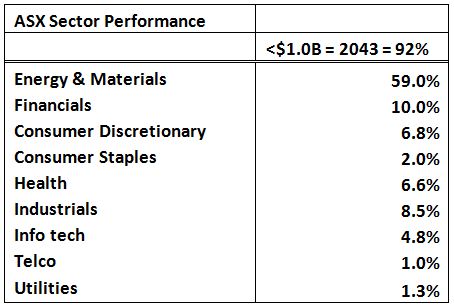

Our market is so heavily resource-focused in fact that 59% of listed ASX stocks with a Market capitalization of less than $1 Billion are in the Energy and Materials sectors. These stocks all fall into the Small Resources category. Of the 2221 listed on the ASX, 2043 have a market capitalization of less than $1 Billion dollars. This represents 92% of all listed ASX stocks, and helps explain why these stocks have such a profound influence on the sentiment of our overall market.

So here’s why the Australian market largely behaves like it does.

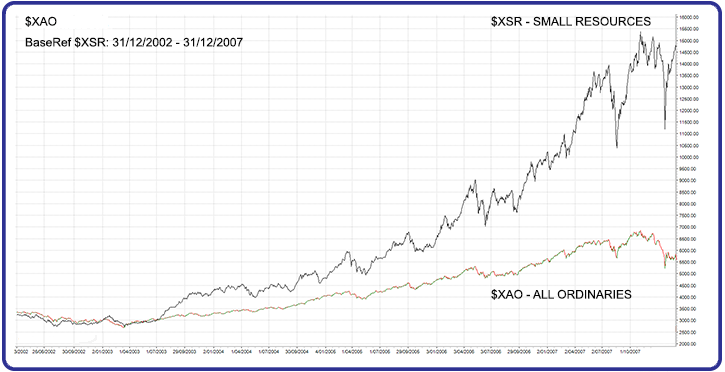

Take for example the performance of the Small Resources Index compared to the All Ordinaries during the period 2003 – 2007. Over this period, the Small Resources Index rose from 1272.79 to 6281.77, an increase of approx. 392%, compared to an increase in the All Ords of just 116%.

This growth in the small resources sector can be attributed to the huge demand for our commodity resources from the rapidly expanding Chinese and Indian economies. China in particular had a voracious appetite for resources during this period as its economy was expanding rapidly and its manufacturing sector was also experiencing huge demand for goods produced in China from western economies.

This spills over into positive sentiment towards listed companies that are not necessarily producing but have the potential to, which in turn leads to rising stock prices across the sector. The Small Resources sector was thus a major contributor to the rise in the value of the All Ords Index during this period.

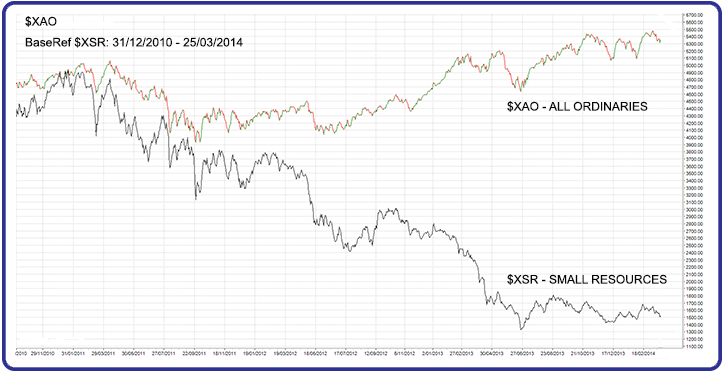

If we then compare this to the last 3 years, we can also see the effect a poorly performing Small Resources sector has on the market. With the Small Resources sector in a severe downtrend, the net effect on the All Ords, has been a protracted sideways market. In essence, our market overall, has just not been able to get moving!

As you can see from the charts, this lack of momentum in the overall market, is a direct result of a falling Small Resources index, reflecting a bear market in the majority of these smaller resource based stocks. Whilst the Small Resources in used here on its own to make the point, the $XMR, the Mid Cap Resources index shows a similar drag on the All Ords.

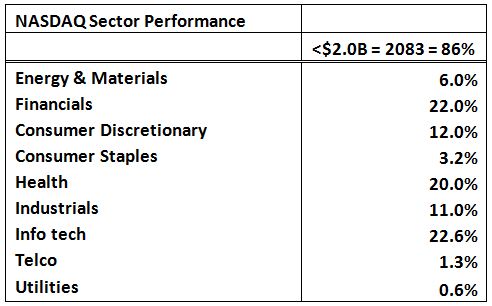

By comparison, the NASDAQ Composite Index has just 6% of company’s associated with Energy and Resources. The spread of stocks across industry groups makes the NASDAQ far less dependent on a particular industry as there is a much broader base and depth of stocks, as can be seen in the table below:

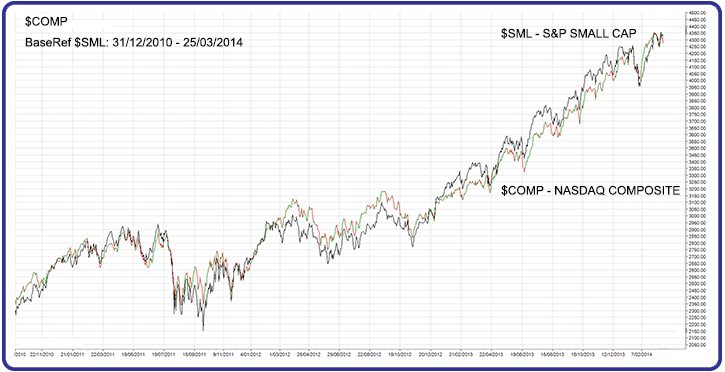

The net result is a much smoother relationship between the NASDAQ listed small cap stocks and the NASDAQ Composite Index, as shown in this chart.

The $MID, the S&P MidCap 400, shows a similar outcome.

Using these charts, it is quite easy to see the enormous effect that the small cap resources stocks have on the Australian market. When demand for resources is high these small cap stocks driven by speculation of discovery, higher commodity prices, potential future profits, and booming demand combine to have a positive impact on the All Ords. When this sector is in decline, as we have experienced over the last 3 years, the negative impact on the All Ords can be equally as strong.

Is the Australian stock market going through a wave 1 of a new 18 year cycle, I.e. an accumulation phase?

shame that penny dreadfuls have such control over our market proves Ozies are gamblers and all are wanna be millionares