People that successfully plan for retirement do so in a sequence or in small events. They understand the importance of retirement planning and hence seek the required knowledge and do the necessary preparation. Mark Twain famously said “The secret of getting ahead is getting started. The secret of getting started is breaking your complex overwhelming tasks into small manageable tasks, and then starting on the first one”. Proper retirement planning is complex and I hope that my articles have provided you with adequate information on the factors that influence successful retirement.

This week I continue on the topic by discussing potential investing returns.

Investment returns

The subject of investment returns is incredibly difficult to tackle but the reason I feel so strongly about having to do so is because far too many investors are oblivious to the types of returns on offer against which they should benchmark potential growth for their capital. While it’s impossible to outline every potential strategy within each vehicle and each strategy’s potential returns, I have focused on some of the more widely used investment instruments and their historical returns. Rather than leave it at that, I’ve also used our more active jogging strategy, SPA3, to compare the results and to demonstrate what kinds of returns are possible when implementing an active strategy.

Future Performance is typically relative to risk

The future returns you desire are relative to how much risk you are prepared to take and how much preparation and effort you put in. Yes, just like most, or all, things in life. The kind of retirement you lead one day isn’t going to magically take care of itself without some preparation and effort on the way to getting there.

Performance and risk are linked. An example is the cash return compared to Australian Shares outlined in the table below. Relatively speaking, cash offers one of the poorer performing long term investments but carries little risk (not no risk as banks and financial institutions do fail, remember Pyramid Building Society in Victoria?). Compared to investing money in the market where there is more potential for upside but the risks increase if one does not know how to handle them.

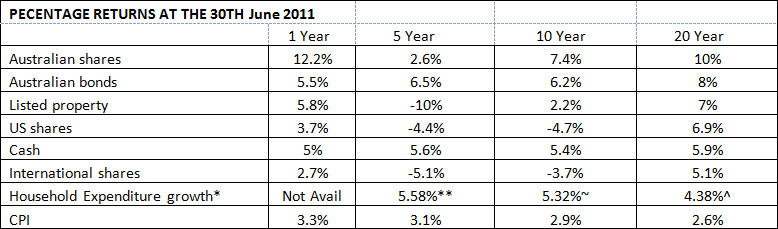

I have two tables for you today. The first table includes the 1 year, 5 year, 10 year and 20 year compounded percentage returns of Australian shares, International shares, US shares, Australian bonds, List property, Cash, CPI and Household Expenditure growth in Australia.

This above table is for informational purposes only and is not intended as investment advice. Sources: Andex 2011 and Australian Bureau of Statistics. * = to June 2010. ** = 6 years, ~ = 11 years, ^ = 21 years.

As was explained in Part 1 of this Blog series, it is suggested that either the Household Expenditure growth rate is used as your benchmark for the rate at which your money declines in value or you should calculate your own inflation rate which is different for all of us depending on your age bracket, how you spend your money according to your lifestyle and where you live.

The idea is that you calculate the purchasing power of your future dollars with today’s prices. For example, subtract the Household Expenditure growth rate from the rate of return of the asset class you anticipate using as your main investment medium. Assume Australian Bonds over 10 years at 6.2% minus 5.32%. This leaves a net growth of 0.88%!!!!!

And then there is tax to account for……

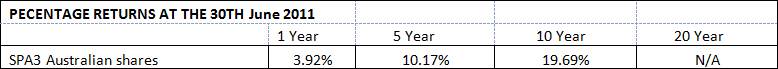

In comparison, SPA3, using a risk management strategy whereby your portfolio totally steps aside from high risk markets as signalled by SPA3, has achieved:

All returns shown include costs like brokerage but exclude tax.

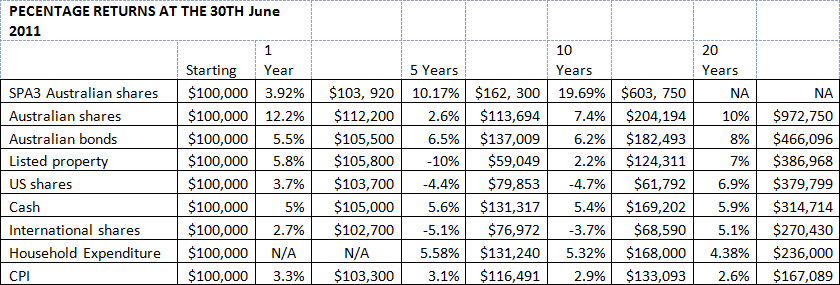

The second table outlines the 1 year, 5 year, 10 year and 20 year performance returns starting with $100,000 (excluding tax).

This above table is for informational purposes only and is not intended as investment advice.

In Part 2 of this series we provided a spreadsheet that will allow you to enter your own capital, anticipated CAGR, no of years to retirement, and inflation rate to calculate the potential future value of your retirement nestegg in today’s dollars. Download the spreadsheet here.

The bottom line is that investors have to take some risk to ensure that their investment capital is not just being eating away by inflation.

Retirement planning requires long term big picture perspective. It requires devising a select few investment strategies and sticking to them with nimble adaptions as more knowledge is attained and as investment conditions change, as they inevitably will, without losing your nerve and throwing out your entire strategy.

Big picture perspective understands that an advantage of as little as a 2% – 4% compounded per annum makes a massive difference over 20 years and hence does the necessary preparation to achieve how to take a little more risk to achieve a little more compounded return.

SPA3

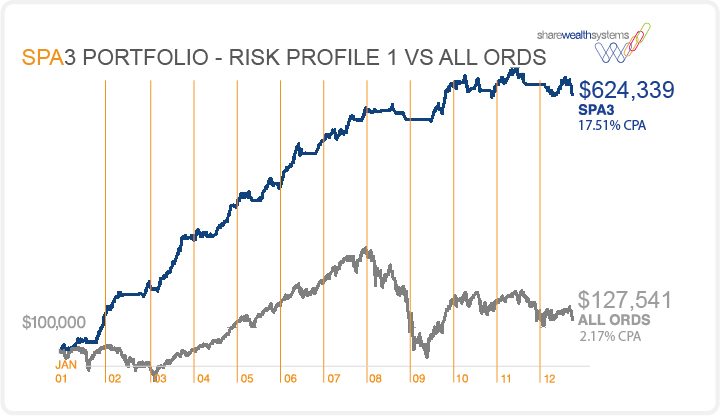

The SPA3 portfolio performance dates back to January 25th 2001 starting with $100,000 and the portfolio provides a classic example of what type of performance is possible with an active approach to managing capital and risk in the market.

SPA3 is a medium term jogging strategy (discussed last week). It takes on average 10 minutes a day to manage a SPA3 portfolio of stocks and the strategy endeavours to extract profits from the trends of shares which creates compounding.

The equity curve shown above is a marked-to-market equity curve of the SPA3 Portfolio – Risk Profile 1. The portfolio started on the 25 January 2001 with a $100,000 capital injection and has grown to $624,339 as at the 30th March 2012.

The equity curve above shows the daily value of the portfolio (blue line) compared to the daily value of the ALL-ORDS Index (grey line). The equity curve includes unrealised profits or losses on any given day and also includes dividends and interest earned during the life of the portfolio, when the portfolio was mainly in cash from following the SPA3 risk management rules.

Like it or not everyone grows old. It’s inevitable. But the question is: will you be ready when you reach retirement? We all know it’s coming sometime in the future, but unfortunately, few adequately plan for its arrival. The effort leads to reward and financial safety which is what we all seek in retirement.

We all want to be comfortable as we get older and reap from what we have sowed. It wouldn’t be prudent to depend on others to help us ensure that we will be financially stable as we age so we must take the initiative to ensure that we are taking care of our tomorrow with a bit of careful planning today.