Performance You Can Rely On

Impressive Returns with SPA3 Investor

We deliver results. The SPA3 Investor – US Equal Weighted Stocks Portfolio showcases real-money performance that’s hard to ignore.

This is the additional profit generated by our real-money portfolio, using our mechanical trading system, over a 9.15-year period from 1 January 2016 to 28 February 2025. This figure excludes monthly fees of $99. The portfolio delivered a profit of $153,988, compared to $133,927 by the S&P500 index over the same period.

The real-money “open-book” U.S. Public Portfolio, operated by Share Wealth Systems, achieved an annualized return of 12.37%, starting with US$70,000. Over the same period, the S&P500 index returned 13.52% annually. For comparison, the VBIAX Vanguard Balanced Fund, a common proxy for 401(k) accounts, achieved a 9.09% annualized return, or US$85,337, which is US$68,651 less than the return from our U.S. “open-book” Public Portfolio.

It’s important to note that actual dollar returns will vary based on your starting portfolio size and the duration over which you run your portfolio.

Performance Comparison

- 5-Year Return: SPA3 Investor 15.80% | S&P500 Accum 16.83%

- Since Inception: SPA3 Investor 12.37% | S&P500 Accum 13.52%

These returns, calculated before fees as of 28 February 2025, underscore our ability to not only compete with but outperform major indices.

Transparent and Verified Results

Transparency is key to trust. Every trade executed since 1 January 2016 within our real-money SPA3 Investor US Portfolio is available upon request, underscoring our commitment to openness and your investment confidence.

The portfolio’s equity curve, which includes all dividends and brokerage fees (excluding franking credits and our flat fees), provides a clear visual representation of growth and profitability over time.

Understanding Our Fee Structure

Fair Fees for Unmatched Service

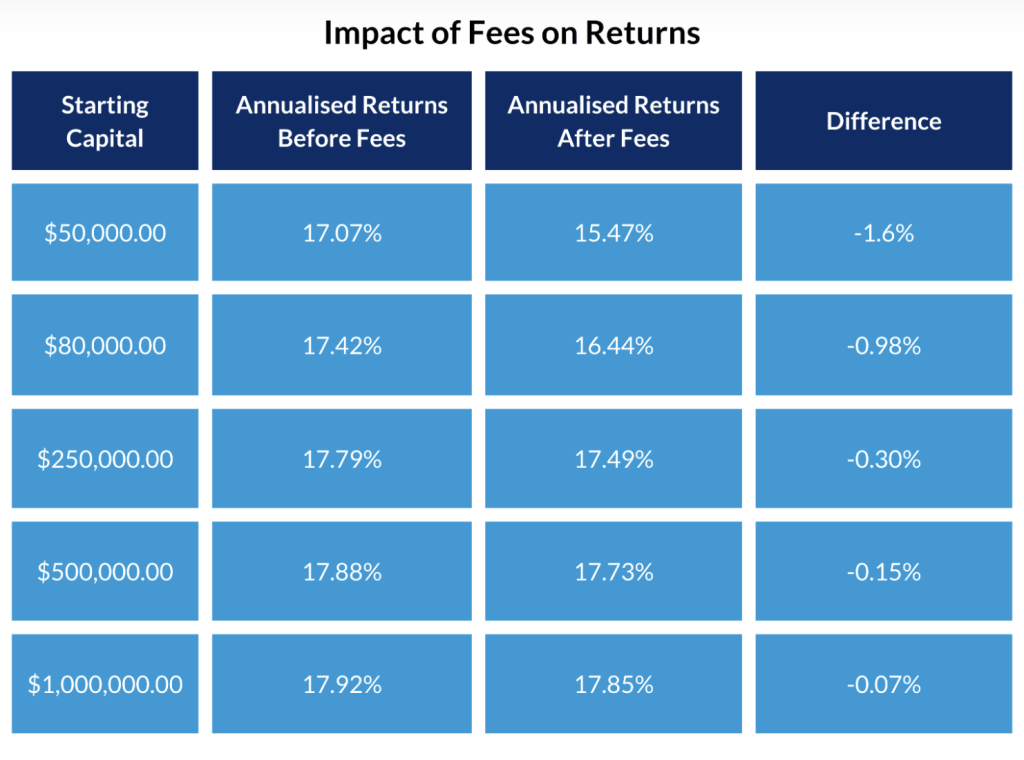

Unlike traditional investment funds that charge percentage-based management fees, Share Wealth Systems employs a flat fee model. This means the cost of our comprehensive service—including ongoing education, support, trading alerts, software maintenance, and more—remains constant regardless of your investment amount.

This structure ensures that as your portfolio grows, the impact of fees on your returns diminishes, allowing you to retain a larger portion of your gains.

Impact of Flat Fees on Portfolio Performance

This table showcases the minimal impact of an $99 per month flat fee on various portfolio sizes, further illustrating our system’s efficiency and the advantage of choosing our annual $1045 fee option to reduce costs even more.

Ready to See for Yourself?

Experience Our Winning Process

Curious about how our SPA3 Investor system can transform your trading results? Sign up for our FREE 21-Day Trial today—no credit card required—and start experiencing the power of a verified, systematic trading approach.

Join the ranks of successful traders who have leveraged our strategies to achieve unparalleled market success.

High Performance, High Returns

Swing Trading Success with SPA3

Swing trading requires precise timing and a deep understanding of market momentum—both of which are strengths of our SPA3 system. By focusing on medium-term price movements, our strategy capitalizes on swings in market prices, providing robust opportunities for substantial returns.

Harness Advanced Analytics for Smarter Decisions

Our sophisticated trading systems offer in-depth analysis of market trends, enabling you to identify profitable trading opportunities quickly and efficiently. Access specific tools and metrics such as volatility assessments, trend analyses, and risk management features that will help you optimize trading strategies for better performance.

Evolution of Our Trading Systems

Our trading systems, including those used for swing trading and momentum trading, are regularly updated to adapt to changing market conditions and incorporate the latest in trading technology and financial research. This commitment to innovation ensures that our strategies remain at the cutting edge, offering our clients the best possible returns on their investments.

Expand Your Expertise with Our Trading Courses

Beyond providing top-tier trading systems, we offer comprehensive trading courses designed to enhance your knowledge and skills in advanced trading techniques. Whether you're interested in refining your swing trading strategy or exploring new trading strategies, our educational resources provide valuable insights and practical guidance to help you become a more skilled and confident trader.

Real Stories from Our Successful Traders

Nothing speaks louder than success.

Read about how our clients have used the SPA3 Investor trading system to transform their trading experiences. From achieving substantial profits through swing trading to consistently beating the market with our automated trading systems, these testimonials serve as proof of the effectiveness of our methods and the real impact they can have on our clients’ financial success.

Rob P.

Member Since September 2009

Len L.

Member Since June 2009

Brian T.

Member Since August 2000

Geoff M.

Member Since August 2014

Steve V.

Member Since August 2008

Garth G.

Member Since November 2005

Join the Community of Successful Traders

Start Achieving Exceptional Market Returns

Ready to elevate your trading game? Join a community of successful traders who rely on our verified trading systems and strategies to achieve their investment goals. Sign up now for our FREE 21-Day Trial and start your journey to becoming a more successful and confident trader with Share Wealth Systems.