This week I’ll try to take a different tack on trying to explain the workings of a successful investment strategy, that of making a cake.

Look at the list of ingredients that are used to make most types of cakes and typically most of the individual ingredients that are used in just about every cake would not be nice to eat on their own. Would you eat any of these ingredients on their own, as they come?

Olive oil, self-raising flour, plain flour, bicarb of soda, cinnamon, raw eggs or eggwhites, vanilla essence, tablespoon of butter, food colourings, cream of tartar, cocoa powder…..

Yuk!

However, combine a number of these awful tasting individual ingredients with a few others into a process in the right mix and measure, change their state slightly, add some heat, and presto you have a fabulously tasting cake.

Get the mix and measure incorrect and don’t follow a tried and tested recipe and the same individual ingredients combined together could turn into a toxic flop.

The same can occur with devising a successful investment strategy. The indicators of a given system used on their own my not be the ‘best’ or ‘different’, or the risk management market timing on its own might be OK but not provide sufficient outperformance, or the position sizing on its own might keep losses small but not create growth.

But combine them together in the right mix and measure and suddenly you have a powerful investment growth recipe.

Oftentimes critics will look at individual parts of a strategy and criticise the:

-

indicators used as there are ‘better tasting’ ones, in their opinion and according to their ‘taste buds’,

-

systematic risk market timing because, on two of three occasions (out of 50), it could have ‘tasted better’,

-

position sizing algorithm because it does it slightly differently to the regurgitated mainstream methods (because they don’t have the tools to do it).

But when these ‘ingredients’ are combined together in the right mix and measure and executed according to a recipe, they can be the icing on the cake, let alone a fabulously tasting cake.

But how do we know that the cake will taste nice when these ingredients are combined together? This is achieved through stress-testing the combined ingredients in the recipe and the ‘tongue tip test’ of using the recipe in real life situations.

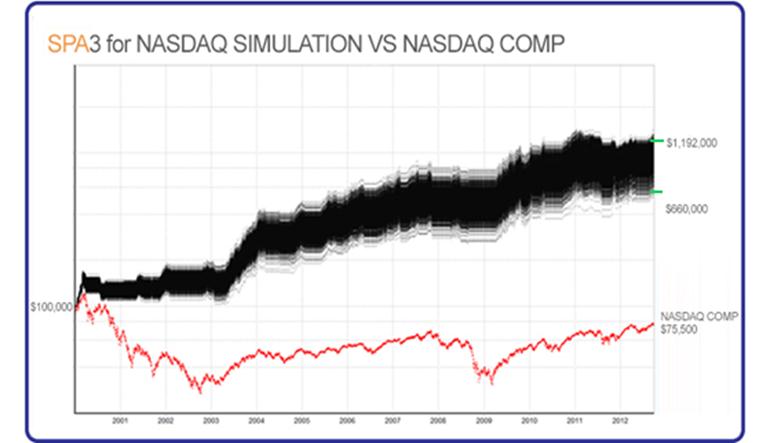

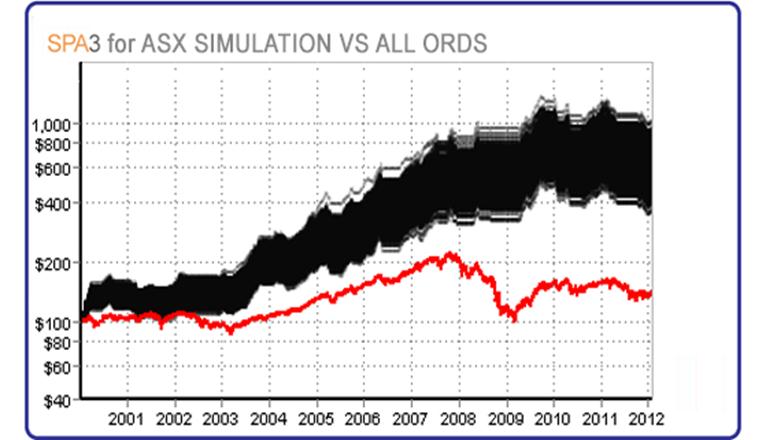

The stress-testing is conducted using Exploratory Simulations of 100’s of 1000’s of historical portfolios that are compiled using the ingredients of the strategy exactly according to the recipe. The range of outcomes of the historically executed recipe are then analysed against a ‘taste benchmark’ to determine how well they perform relative to that benchmark. This stress testing was conducted in two ‘kitchens’, the Australian and the NASDAQ, and revealed that ALL outcomes of stress-testing were far better tasting than the benchmarks by a large margin.

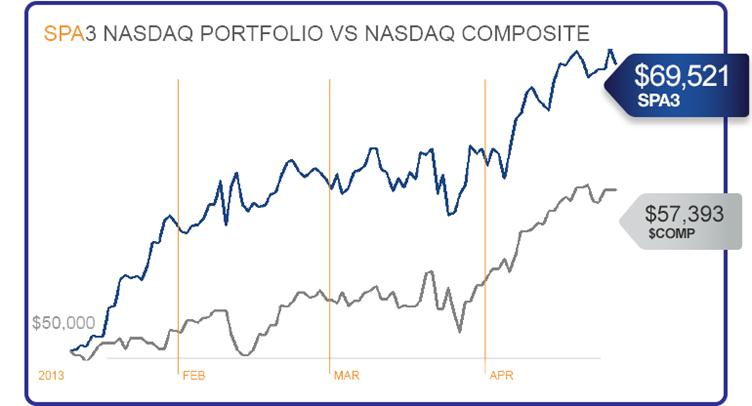

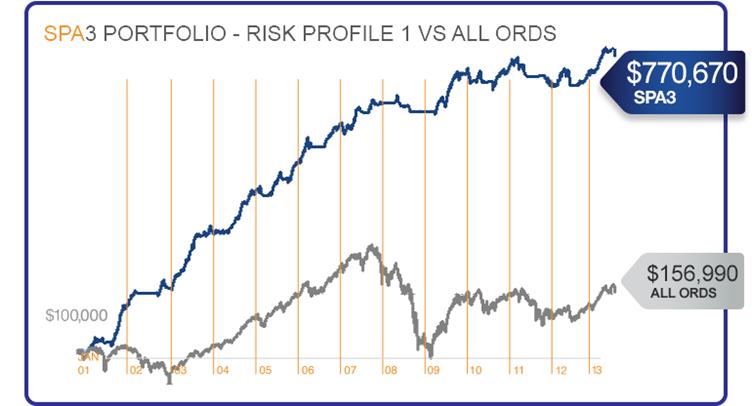

The ‘tongue-tip test’ demonstrates the same outcomes, far tastier than their respective benchmarks.

If you are ready for the ‘tongue-tip test’ please register for a one-on-one demonstration here or download The Trading Manifesto for a detailed explanation on how we conducted the stress-testing.