Trade with a Verified Framework

You don’t need to try to predict every day’s move to trade properly. We help you stay committed with a clear, verified process.

Your Transformation at Share Wealth Systems

The Mechanics

A Fully Mechanical, Rules-Based System

A data-driven, fully mechanical trading system with a proven statistical edge. Back-tested to 1992 and live-traded profitably since 2016, including the COVID crash.

- The first stage of trading mastery is the mechanical stage. In this stage, you:

- Remove discretion and emotion from decision-making

- Learn to execute a trading system flawlessly

- Build deep confidence through consistent, repeatable behavior

- Develop an unshakeable belief in your ability to trade consistently

Each SPA3 system applies these same mechanical principles to different markets and objectives.

Learn exactly how each one works

What The System Tells You

- What to buy

- When to buy

- When to exit

- How much to allocate

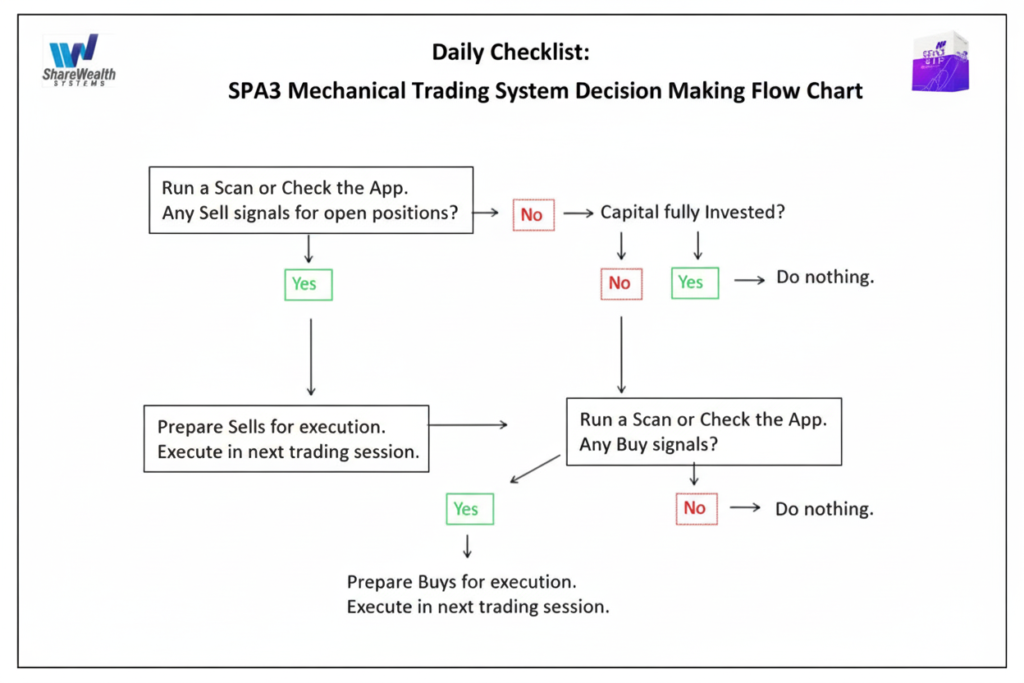

The Daily Process

The entire daily process is designed to be simple, repeatable, and emotionally neutral. Most members spend an average of 30 minutes per week or less.

The Path To Your Transformation

Unlock Reward

Pay only after you make profits, after completing the required introductory content and booking a Discovery Call.

Foundational Training

Your foundation for learning clean, rules-based execution.

LTTP Study Group

Learn To Trade Properly (LTTP) is a live-trading study group that uses the system to train and skill you to execute properly.

Scale Up

Increase portfolio size to generate higher absolute profits.

Partnership Model

What We Provide

A core rules-based system designed for skill building & 20% annualized returns

Guided live-trading to practice consistency (LTTP)

Skills Acquisition Trading Plan, Portfolio Tracker, Charting Software

Support & Community to keep you accountable to attaining skills

What You Bring

Time commitment: 2 hrs / week for 14-16 weeks

Commitment to follow rules; no mid-trade negotiation

Open mind to attain proper trading skills and habits

The Mechanics and the Mindset: Training & Execution Path

The Five Stage Runway

How We Train You to Execute Consistently

Stage 1 – Become a Peaceful, Profitable, and Protected Trader

Build clarity around your goals, risk, and process before live-trading. Learn to navigate a calm, repeatable process and start defining your trading identity. Accept and understand clearly why a specific learning system is required to learn to trade properly.

This prerequisite stage takes 1–4 weeks and prepares you for live trading.

Stage 2 – Fix the Process

We provide a rules-based trading process that SWS has coached since 1998.

SPA3 Income is the trading process used in the Foundational Training and LTTP Study Group. It will fix any subjective, loose or ambiguous analysis process that you currently use.

It has an objective, researched and live-traded “edge”. It’s entry and exit signals meet the precise definitions stated by Mark Douglas in his book Trading in the Zone on page 190.

Stage 3 – 3 months of Skills Acquisition

Trade live with ‘small’ amount of capital using SWS’s Practice Model to turn rules into confident execution.

This stage combines the verified SPA3 Income mechanical system with skills-acquisition and habit-building training and live practice.

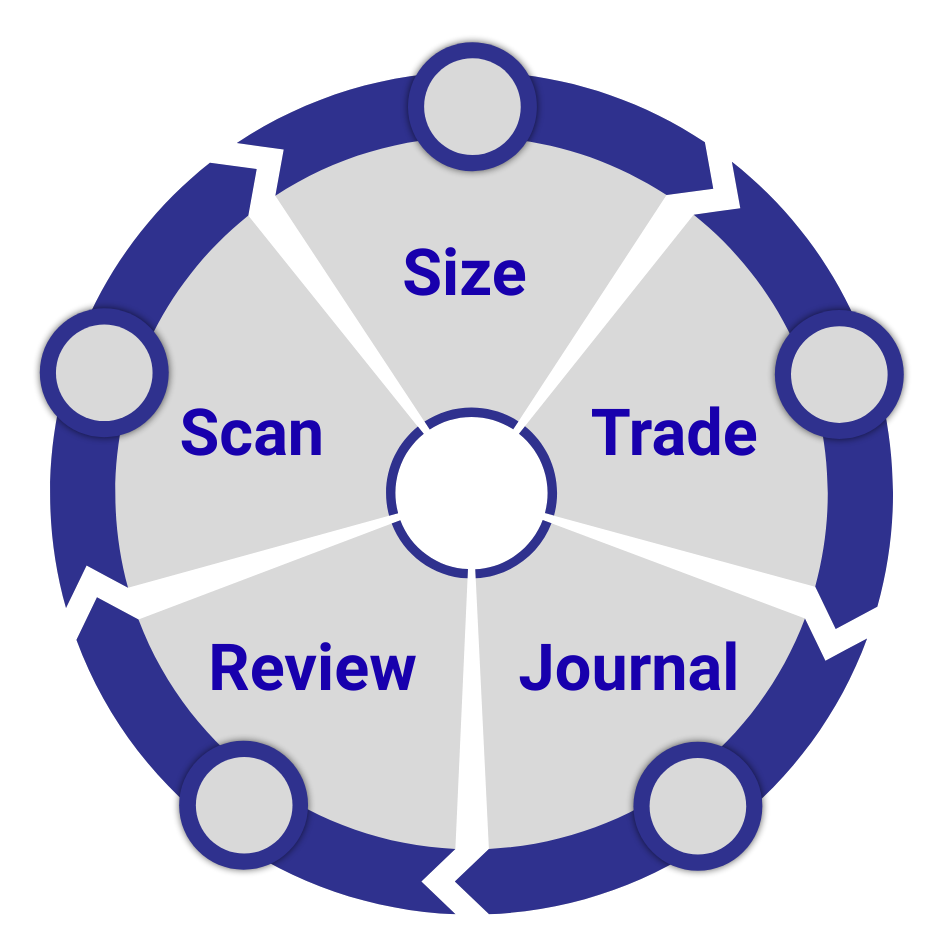

Using principles from Trading in the Zone and Atomic Habits, you build repeatable routines and apply them live with a small practice fund through the simple loop shown.

This guided phase takes about 2 hours per week for 3 months, then just 30 minutes per week on average, ongoing for the rest of your life.

Stage 4 – Deep Practice with Feedback

Refine your execution through deep practice mistake rectification and feedback. Track rule compliance, expectancy, and drawdowns. Adjust risk through position sizing to levels you can sustain.

Continue until your mind is conflict-free, proves resilient under pressure, has traded through multiple drawdowns and recovered back to new portfolio highs by removing mental friction, not by adding analysis complexity.

Stage 5 — Scale with Confidence

Scaling profits is the reward for achieving consistency.

Once consistency, through rule compliance, risk acceptance and drawdown resilience is accomplished,, you can increase capital and add other mechanical systems while managing portfolios in about 30 minutes per week on average.

Consistency cannot be achieved before confidence is developed to execute trades properly.

Confidence cannot be internalized before trust in the process to be executed is attained.

Trust in a process cannot be cultivated without self-proof that a process works. And will continue to work.

Self-proof that a process will continue to work requires that the process be objective, unchanging and repeatable. You cannot reliably repeat an action or process that keeps changing its definition. Nor can you trust proof, is sustainable into the future if it’s criteria keep changing, i.e. are subjective and open to interpretation on-the-fly.

How SPA3 Income and LTTP Work Together

SPA3 — Apply the Rules

SPA3 Income provides the mechanical growth or income engine. It delivers objective, non-discretionary rules for entries, exits, position sizing, and capital resets purpose-built for swing trading leveraged ETFs and generating sustainable growth or income.

LTTP - Build the Trader

LTTP trains you to operate under pressure. It develops the skills of discipline, emotional control, confidence, and self-awareness required to trade properly — especially when drawdowns, losses, or missed profit trades trigger emotional responses. This is where you learn to stop reacting and start executing properly.

Habits — The Bridge

Habits turn knowledge and skills into automatic behaviour. Through repetition, structured checklists, and routine execution, trading actions become consistent and part of your identity, even when markets are volatile or income expectations are tested.

The SPA3 Rules-based System creates profit from process. LTTP builds the trader. Habits lock in execution into the future.

How to Join Learn To Trade Properly

Profit Before You Pay

Designed for committed learners who want results before paying for product and tuition

$0

Decide within 14 days of the end of the LTTP whether to continue

- If yes → we invoice US$2,495

- If no → access ends

If profits are not achieved

- You may continue trading with SPA3 Income

- Once US$2,495 profit is achieved → you are invoiced

Monthly fee

- US$99/month (data + support)

- Starts at the end of the month you decide to proceed

- Non-refundable (same fee all members pay)

Important note:

This option is not publicly available and is only offered to qualified candidates after they’ve invested time understanding our process.

Need More Clarifications? Contact us or Visit Our FAQ Page

Feedback From Our Customers