In February this year, I wrote one of my most well-read and distributed blogs entitled “History Making Event on the Horizon”. Feel free to read it again right now.

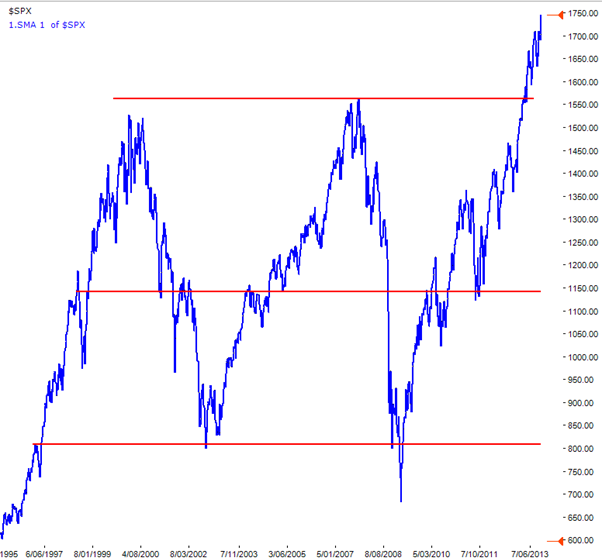

The event discussed was the potential breakout by the S&P500 of a 13+ year range to a new all-time high thus potentially signalling:

- the end of the secular bear market that started, with the benefit of hindsight, in the United States in March 2000, and

- the start of a new secular bull market.

The breakout event first occurred on 10th April 2013.

Looking back to November 2012 when the current trend in the S&P500 started – following a 60% retracement of the previous trend just prior to November – the S&P500 has followed a text book up trend with higher lows and higher highs. For the technically minded, the five retracements in this trend to each higher low has been very close to a 23.6% Fibonacci retracement. To have five retracements in a row with such shallow retracements indicates how strong this trend has been. It has now been going for a few weeks shy of a year.

The S&P500 made its latest new all-time high on Thursday last week 17th October. The following day the All Ordinaries reached a new 5+ year high at 5322, a level last seen on 30th June 2008! The breakout event and its ensuing follow through is seen clearly on this daily chart of the S&P500.

The fundamentals driving this market that I mentioned in the blog in February are still very much in place. In fact, I omitted one back then, which was the most obvious one, and I will add another driver in this blog that is probably one of the biggest giveaways why there is a high probability that we might just be in the infancy of this secular bull market.

The one that I omitted to mention in February is the ongoing “printing of money” by the USA Federal Reserve. That combined with the Fed keeping interest rates at near 0% levels supports the long-time held view to “Never fight the Fed.”

The other new point to add to the ‘for camp’ to support this being the start of a secular bull market is that there are very very few private investors and “Mum’s and Dad’s” talking about, let alone participating in, the equity markets at the moment. This is the case in the United States and even more so in Australia where participation is just about at all-time lows. This is one of the biggest clues as to why this bull market has some way to go, probably well into 2015 and maybe further.

The equities market will be euphorically overbought and ready for a large correction when shares and stocks, and I mean the really specie ones too, are being discussed at dinner parties and in the elevator, and cabbies and the kebab man have a view.

The equity markets may have just started the phase that leads to a raging bull market. The task of the investor is to become sufficiently savvy to ensure that they get a juicy chunk of any trend that may ensue but, more importantly, to ensure that they have a risk management strategy in place not to be caught in any major correction that might follow thereafter or along the way.

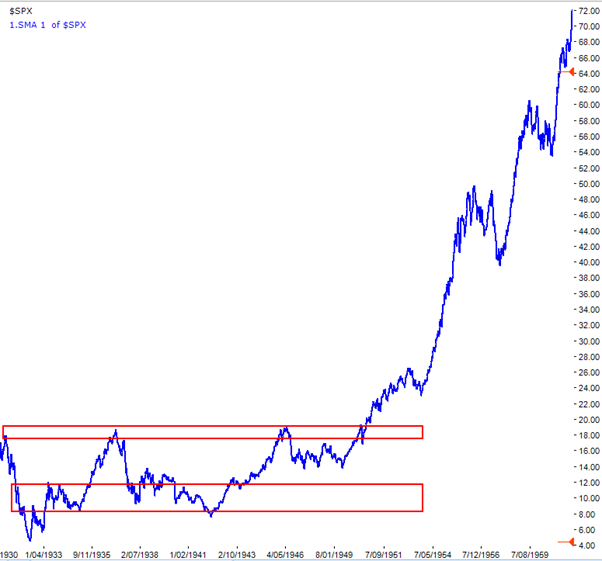

To answer my “Now what?” question let’s look to the past, which is not filled with a large sample of secular bear to bull market transitions but can give us some clues. In October 1950 the start of the secular bull market and the ensuing 10 years looked like this on the S&P500.

In the chart above, the retracement after the initial breakout was shallow and way above the previous high that is marked by the upper red rectangle.

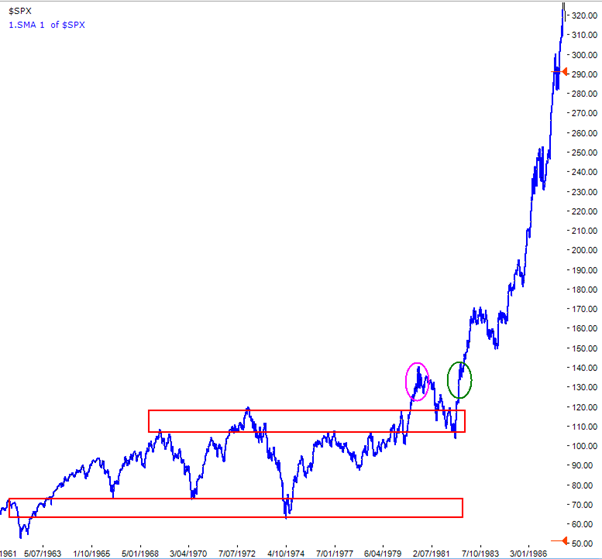

In October 1982 the initial breakout and the ensuing 5 years looked like this on the S&P500:

What we don’t know right now, using the clues provided by the past, is whether:

- we are placed at the magenta ellipse,

- we are placed at the green ellipse,

- we are placed at a similar point to just after the breakout in October 1950, or

- the secular bull market will fail and we fall back into the secular bear market range.

In my February blog I discussed the length of secular bear markets. Another observation on this theme is the length of time between the start of secular bull markets. October 1950 to October 1982 was 32 years. October 2013 back to October 1982 is 31 years. A small sample of just two but a cycle worth keeping an eye on.

There are millions of variables that interact with the markets. Regular readers of this blog will know that I harp on about this all time. So a left field outlier could come along at any time and spoil the party but that is a total unknown and total unknowns always exist all the time. We can only go with what we can see, and right now we can see that an obvious bull market is in place. Not a raging one but it could turn into one very quickly…….

From a technical view, and maybe even a fundamental view depending on which fundamental variables you wish to focus (I have discussed 4 key ones in this and the February blog), it may be a bigger risk to be out of this market than in it. Of course, have a risk management plan as all our customers do by knowing in advance what criteria will take them into cash when downturns come along the way.

In conclusion, look for the following signs to indicate that a raging bull market is on the way or even in place:

- private investor activity rising strongly,

- small and mid cap stocks, particularly resource stocks in Australia, start rising in liquidity, price and volumes (they already are in the United States across all sectors).

- the number of new listings (floats) on the ASX starts increasing,

- bad news is discounted by the markets, that is, just takes it in its stride, and good news is magnified by large market increases,

- stocks start being discussed with friends or strangers at dinner parties and in the elevator of your building.

A quote attributed to anon to finish … “people can be divided into three groups: those that make things happen, those that watch things happen and those that wonder what happened.” If this primary bull market persists into a secular bull market similar to the past you don’t want to be in either of the two latter groups, especially if you have an interest in the markets and had been warned……

12 Responses

Hi Gary

Enjoyed your post. Question, what source do you use to see the level of private investor activity?

Thanks

Paul

Response to Comment by Paul:

Mainly speaking to a number of stock brokers that service retail clients and getting their feedback about their firm and other firms from their networks.

Regards

Gary

advisorperspectives.comThanks Gary

I read this and started to get a bit excited, fortunately you did say “may and “could turn into a raging bull market, so went I to the ECRI site http://www.advisorperspectives.com/dshort/updates/ECRI-Weekly-Leading-Index.php

It was like taking a cold shower, drill into all the links for a more informed view by ECRI supporters

Definitely reinforces the need to follow the SPA sell signals

Of course we all like the idea of a raging bull market much better

Regards Merv

Hi Gary,

All the factors you claim to support a “raging” bull market are the very factors I claim for a market top. As well, you have avoided market sentiment and Advance/Decline and 52 week high/low. This is the thinnest advance probably in the history of the stockmarket, and has been incredibly thin since March 2009. The Dax Index has only risen above its average Advance/Decline zero line for one stretch of 5 days since January 2013, and it has followed this pattern since March 2009. More than 50% of the Dax Index constituent stocks are not participating in this rally, and are between 11% and 100% below their 52 week highs. The US indexes tell the same story. I believe, judging by daily volumes since July 2007, a large part of the stock bought in the decline of 2008 is still in the same hands, and they have been unable to pass it off, regardless of how hard they and the reserve banks have tried to suck in the dumb money. If the dumb money now falls for it, it will most likely signal the end of the bear market rally. All my empiric studies, which I conduct and update on a day to day basis, valued in USD and gold, tell me this is a manipulated market which runs to a script. It is apparent that certain stocks are targeted that have heavier weighting in the indexes, to move the index in the designated direction using the least amount of capital. We reached a Grand Supercycle top in March 2000, fuelled by Greenspans loose money policies, and any measurement of the markets since then in terms of real money, be it gold, or PPI, show a landslide decline since that date, and the process of the correction following that top is years away from completion. I think you have been sucked in. And the fundamentals most clearly do not support your position. The world is a mess socially, politically, and economically, corporate top line has rarely been worse, and consumer demand is in the doldrums and getting worse as personal income and employment continues to decline. I could write a book on the downtrend in the fundamentals. There has never been such a massive divergence between world economic and social fundamentals, and the stockmarkets. Every other world market, be it commodities, forex, metals, etc, has topped out back in 2011 or since. This is the first time I have had a severe divergence with you on any question, but your reading of the the fundamentals and the technical take are erroneous in my opinion. But that is only my opinion. Surely you wrote this piece with your tongue in your cheek, just to draw in arguments such as mine?

Cheers,

Mike Cullen

Thanks Gary, an interesting analysis, as always!

best regards,

Richard

Response to Comment by Mike.

“Anything can happen” as there are a near limitless number of variables that one can analyse in the market to support or not support a notion that one may have.

I could try to “raise you” with a bunch of other variables to support my view but that would require that I go and look for them and, anyway, it would only be a small subset of all the variables that could play a part.

Rather I will look to price action and trust that. It doesn’t matter what anybody’s view is about what it should be doing, reality is what it IS doing. And it is well and truly in an uptrend on the S&P500, NASDAQ and DAX. I will continue to trust this trend until the price changes such that the medium-term signals that I have researched, stress-tested and follow provide an exit signal. And if they provide a re-entry thereafter I will follow that.

As to the longer term future, even though this blog has a forecast in it, I have included some caveats regarding risk management. This is because “I do not need to know what will happen next in order to make money” as I will let the markets do what they will do and react according to my researched and stress-tested methodology.

There is no doubt that the great majority of invetors agree with your view of where the markets might go, that is, down. This is why so few are currently participating in the equity markets. Their fear of the downside occurring is greater than their perceived potential reward from the upside occurring.

Indeed, plenty of commnetary comes across my desk predicting doom and gloom. And their story has been the same for the last 2 and more years.

Despite all the reasons provided by many as to why the equity markets should fall and should have fallen over the last 2 years, since Sept/Oct 2011 the S&P500 is up 58%, the Dax up 75% and the NASDAQ up 67%.

So no tongue in cheek.

Regards

Gary

Thanks Gary,

As usual a nice measured, rational, BS-free look at what is happening.

One of the hardest things we humans face is trusting the system. I have been a SPA user for some time & I still catch myself trying to second guess the markets!

Regards, Dave

Hi Gary

Is this potential for a secular bull market only in the US or Australia too?

Response to Comment by Ato:

For Australia too however my view is that the ASX bull market will be a bit more subdued than the USA equities market, especially when compared to the NASDAQ.

Many feel that Australian equities are lagging USA equities and this is certainly the case since March 2009. The S&P500 has outperformed the ALL ORDS by around 50% since then and the NASDAQ even more.

However, the relative performance of Australian equities since March 2000, which marked the beginning of the secular bear market, is far better than USA equities. Australian and USA equities have taken different paths since then.

A Base Reference (or Base 100) chart starting back in March 2000 will show that the ALL ORDS is still 43% ahead of the S&P500 and 100% (twice as good) ahead of the NASDAQ.

Don’t expect exact correlation however, based on this, and IF the secular bull market continues, my view is that there is more upside potential in USA equities than ASX equities, particularly on the NASDAQ.

Regards

Gary

QE “infinite” is like a rocket under the US share market.

Until QE is turned off the music will keep playing…

Response to Comment by Merv:

There is a lot of “noise” on this link, very confusing.

Also re-inforces the need to follow the buy signals when they occur.

Listening to the “noise” emanating from ERCI the market has risen by the significant amounts recorded in my response comment above while the USA economy has been in their so called recession.

Equities may fall in a heap ….. or they may continue rising……

Either way you will have a clear plan of action with SPA3. I have no idea what plan of action I would take having read the info on the provided link.

Regards

Gary

Gary Thank you for the article and very fair responses. NASDAQ SPA with someone else managing the portfolio remains of interest to me but I cant find an HC Securuties or alternative to do the NASDAQ market.

Perhaps there are others in the SPA community who would also like a managed approach for the NASDAQ ?!?

Regards Jock