Investing $10,000 via managed funds / mutual funds, financial planners, investment advisors, SMA’s etc. would potentially cost you $11,000 in 10 years.

Or $70,000 in 20 years.

Or $336,000 in 30 years.

Or $1,437,000 in 40 years.

I’ll explain the logic behind these numbers in a minute. But before I do that, let the gravity of the losses above sink in.

Then imagine adding another zero or two to that $10,000.

You see, outsourcing your investing to managed funds’ / financial planners’ protects you from two things only:

- The negative feelings that ALWAYS come from losing, being wrong, missing out and not getting more out of the deal with the benefit of hindsight…

- The “hassle” of managing your own investing.

As you’ll soon see, this service comes at a hefty price paid in your investment returns (through the fees you pay and as a consequence of overdiversification. I’ll go in-depth on both later).

Plus, it opens you up to the biggest investing risk of all:

Not Having Enough Money To Enjoy A Worry-Free & Financially Self-Sufficient Retirement

Before I give you rock-hard numbers that will back up my claim, consider this…

With our lifespans increasing, you now must prepare for 25-30 years of retirement. Meaning you need to have enough funds to enjoy the same (or hopefully even better) lifestyle than when you were working.

If you do the calculations, you’ll discover that saving 12% (or less) of your monthly salary…

While achieving 8.5% (or less) annualized returns over a lifetime of working & investing…

Will NOT be enough to last a 25-30-year retirement at that lifestyle.

Do some more objective research, and you’ll find that it’s highly unlikely that 3rd party money managers (brokers, financial planners, managed funds, asset managers, etc.) will consistently achieve more than 10% annualized returns over 30+ years of investing.

But as a DIY investor you can, with the right mindset and investing process, get to 12%, or even 14% annualized returns. Or more.

Don’t let the financial fraternity convince you it’s not possible – I’ve done it myself and so have many Systemized Investing Program members. And there are plenty more examples beyond my near environment too.

Sure, going down the DIY route is far from easy. It involves working on getting the necessary investing skills and facing primal fears & emotional pain.

But it is your best bet for having enough to enjoy a financially self-sufficient retirement.

That’s because of the difference getting 12-14% annualized returns makes in comparison with the maximum 10%, but more like 6% to 8%, you can get by outsourcing your investing to nearly all 3rd party investing options.

Let me explain:

The Actual Difference An Extra 1% Of Annualized Returns Makes

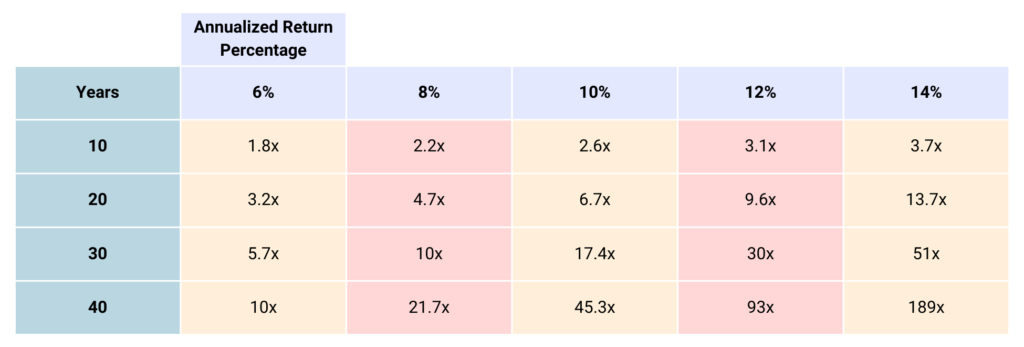

To understand the gravity of this difference, check out this Table 1:

The numbers below each of the annualized return percentages are capital multipliers. They show how many times your capital will increase if you achieve the returns that go with it.

So, in the absolute best-case scenario, outsourcing your investing to 3rd parties puts you in column 4 of the above table (10% annualized).

The DIY route, if done well with a battle-tested system and the mindset to execute it, puts you in column 5 or 6.

To see the difference in $ terms, let’s say you start investing at the age of 25 and have $5,000 of starting capital…

If you get 6% annualized returns, you’ll have $9,000 (1.8x more) in 10 years.

With 8% annualized, you’d have $11,000 (2.2x more).

10% annualized: $13,000 (2.6x more).

12%: $15,500 (3.1x more).

But with 14%, you’d end up with $18,500.

Now do you see why I said outsourcing your investing to 3rd parties would cost you $70,000 in 20 years or $1,437,000 in 40 years if you start with $10,000?

It’s the difference between achieving 10% and 14% annualized returns.

Also remember I’ve been kind to managed funds and the like, as they usually don’t get close to those 10% returns.

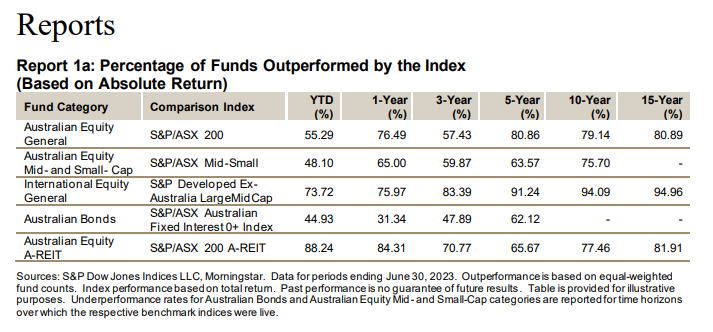

SPIVA Persistence Reports

The SPIVA Scorecard and SPIVA Persistence Reports show that managed funds can’t beat the Total Return Index of the stock market over the long term.

For example, According to S&P Dow Jones Indices Australian SPIVA Scorecard, 80.89% of Australian Equity General funds were outperformed by the ASX200 Accumulation index over 15 years to June 30, 2023, and 80.86% over 5 years.

In the U.S. it’s even worse, with 92.19% of all Large Cap funds underperforming the S&P500 over 15 years to 30 June 2023.

Sure, 3rd party investing options get you a better risk-to-reward ratio than the market. And you will have some protection when inevitable drawdowns occur. But at what cost?

(I’ll go into more detail on Risk-to-reward ratios in future blog posts.)

The Trade-Off You Make When Outsourcing Your Investing to 3rd Parties

Outsourcing your investing to 3rd parties only helps you avoid the emotional hurt and negative feelings that come from the four primary fears (losing, being wrong, missing out, and leaving money on the table.).

Sure, these fears will regularly “hit” you as a self-directed investor. And outsourcing your investing mostly eliminates these feelings of hurt.

But in doing so, you also sacrifice the opportunity to achieve the returns you actually need for a financially self-sufficient retirement.

If you really want to ensure such a retirement, you must outperform the index by at least an average of 2% annualized consistently for many years.

The worse your investments have performed up until now, the bigger the required percentage return becomes, going forward.

And the table above shows that 3rd parties generally don’t come close to this.

My calculations show that the stark reality is this:

If you want to enjoy your Golden Years, you have to save closer to 15% of your monthly salary for ALL your working years…

Or achieve better investment returns while you are working AND are retired.

12% annualized returns would cut it. (But if you achieved 7% or less during most of your working life — you’ll need even more than 12%.)

In other words, you must come as close as possible to the right of Table 1 from above.

And no, 3rd party investing options can never get you there. For two reasons.

Why Outsourcing Your Investing Won’t Consistently Get You More Than 10% Annualized…

1. Percentage-Based Fees

Consider the percentage-based fee listed on your fund manager’s invoice. The financial establishment presents it as the only cost of their services and expertise.

Yet, the truth is it’s just a teeny-tiny part of the price you pay.

Let me explain:

Everyone knows that the more you make, the bigger this “transparent” fee becomes. This part is clear. And some even think of it as a good incentive.

But what about the growth side of the money that goes to your fund manager?

If the money was still in your pocket, you could have invested it and earned a return on your investment. And you could have reinvested those returns and earned further returns.

The more time passes, the bigger your losses get. That’s because the compounding effect works the same for your fees as it does to bring you superior returns.

Plus, on top of these mutual fund fees comes the cost of financial advisers (e.g., 66% of IRA (self-directed) investors in the United States use financial advisors).

The difference typically paid in recurring fees to said advisers is around 1% per year of FuM (for face to face but less for online or robo-advice).

And you pay the fees for the rest of your investing life. (Note: I’m definitely not against having a financial advisor – this can be very beneficial. But you should pay them a one-time flat fee for their specialist services, instead of a percentage-based lifetime fee that scales higher and higher.)

This combination of advisor fees and active mutual fund fees WILL potentially cost you hundreds of thousands of dollars in direct costs and lost compounding, over a 20-year period. As you’ve seen in the examples above.

“What happens in the fund business is that the magic of compounding returns is overwhelmed by the tyranny of compounding costs. It’s a mathematical fact.”

John Bogle

2. Overdiversification

Mutual funds and the like tend to engage in way more diversification than necessary to keep your assets safe…

Leading to stifling your investment growth.

This is “excessive caution”, as author and investing consultant Charles Ellis calls it.

Look, when done right, diversification is great for protecting your wealth.

But engage in too much of it, like the mutual funds do with up to 80% of your savings…

And it will hamper your growth potential more than it protects you from market crashes.

In most cases, taking personal control is the only way to get the investing flexibility and agility YOU need to balance growth and protection to achieve YOUR long-term nest-egg goals.

Outsourcing your investing to a one-size-fits-all Balanced Fund or cookie-cutter financial planner simply won’t help you achieve what you need and want.

Why Taking Control Of Your Investing Is So Crucial… And How To Do It

The point of all this talk and numbers (which you can see more of in this article) is simple:

If you don’t want to say goodbye to the lifestyle you were accustomed to while working and maybe even start contemplating decisions like whether or not to turn the heater on…

You must skill up and take control of your investing.

So, if you’re putting your financial future into the hands of others, I urge you to act now and consider your options for creating (or finding) a self-sufficient investing strategy. At least for some of your funds.

One that has the highest probability of funding the retirement life of your dreams. And gets you the best combination of annualized returns for the risk taken and effort expended (aim for 14% returns with 15 to 30 minutes a week of effort).

I’m not saying you should switch gears immediately. But at the very least take a look at what else is on offer.

Dive deep into how every investing option you can take performed in the past. And assess its chances of getting you where you want to be in retirement financially speaking.

Do so in extreme detail and only then choose your investing system and strategy.

If your choice happens to be becoming a self-directed investor, and you want help ensuring you turn into & remain a consistently profitable one…

You know where to find me.

Whatever you do, at least ensure you’re the master of your own destiny and financial future. Instead of putting that future in the hands of a corporation you’re just a number to. And whose chances of getting you where you want to be in retirement are virtually non-existent, as the numbers I laid out above showcased.

To your investing success.

Gary Stone.

P.S. I published a book, Blueprint to Wealth, in 2016 where you can learn lots more about the huge negative effect of fees and over-diversification of the mutual funds industry. And plenty more about investing…