This isn’t a sales pitch for SWS’s program. Sure, I believe we can help you become a profitable and peaceful investor fast and for the long term.

But you can do so yourself, if you so please. The key to success lies in the traits, methods, and beliefs I will go into in today’s article.

If you internalize those traits and work on building a method and mindset that are in tune with the market…

I daresay you’ll not only become the investor from the headline…

But also lead a more calm and successful business, personal, sports, etc., life.

Still, let’s stick to investing for now. The question I often get is:

“I understand aiming for profits. But what does the term “peaceful investor” mean? And why should I strive to become one?”

In essence, it means not worrying and stressing over your investment decisions.

It means you have a systemized decision-making process you trust and never second-guess.

Most investors can’t relate to this. Instead, they make decisions based on external noise and opinions that constantly change and offer contrasting advice. Or let the outcome of their (and other investors’) decisions affect their next action.

Look, negative feedback will always exist in EVERY environment. This goes double for an environment where your money is involved, such as the stock market.

But you mustn’t let it be your guiding star.

The environment you operate in doesn’t decide who you are or how you feel.

You do!

So, you must look within. And create a state of mind (beliefs, attitudes, your framing of opinions and outcomes) that oozes peace.

In other words, you can’t try to be a peaceful investor. You become one over time.

Sounds all wishy-washy and abstract, I know. But there is a way to train your mind to get there. And having a systemized investing process is at the core of that training.

That’s because such a process doesn’t just encompass a mechanical trading system and investing techniques & tools. It also includes the skills and knowledge you need to effectively use the above…

And achieve your long-term financial goals.

Okay, now let’s finally move from the abstract to the practical. In the rest of this article, I’ll list the 5 key skills you need to become a peaceful and profitable investor…

And explain exactly how to build and use them in combination with investing techniques & tools.

In other words, I’ll show you what’s at the foundation of a systemized investing process and what having one gets you both in terms of money and emotional stability.

Let’s get into it:

Skill #1: Unlock The Path To Peaceful Profitability Through Consistency

Consistency is a “boring” yet fundamental skill you must have to outperform the market while feeling calm and living your life to the fullest.

In fact, you must develop and nurture consistency until it transfers from a skill to a state of mind.

The first step towards doing this is:

Letting go of perfection.

Sure, we all say we know achieving perfection is impossible and striving for it is silly. Yet, not being able to achieve it is a perfect (pun intended) excuse to stop trying to improve at all.

Too many investors give up on the market after a few imperfect events (losses). On the other hand, consistent investors embrace loss because they know it must happen…

And focus on achieving a level of performance that doesn’t vary significantly over time.

You instill consistency in your mind by repeating a similar activity that accumulates in robustness until execution reaches and maintains a high level of sameness and performance.

Or, in plain English, you enjoy the fruits of regular action. And its compounding effect.

So, no “start and stop” activity. No on-the-fly subjective decisions. No ever-changing decision-making basis that relies on emotions and feelings.

Now, if the basis for your regular action is flawed — you obviously won’t enjoy much of a compounding effect. This is where having a pre-researched system and process with a verified edge comes in.

If you have this and learn to think in probabilities instead of certainties — the sky is the limit.

Why?

Well, because then you understand your edge has a probability of <1, not 1. Meaning negative outcomes will happen in clusters…

But things will even out in the long run and your probabilistic edge will deliver your goals and objectives.

This belief frees you from the need of knowing each outcome and removes the fear that comes with it.

You have no expectation of what the market will do.

Your expectations are in sync with the probabilities of your edge, which puts the odds in your favor.

Meaning what was once uncertainty is now opportunity because you frame individual losing trades and drawdown periods as part of your edge. You think of these as a sort of participation cost or fee for achieving superior returns in the long run.

You don’t have to always win, take advantage of every opportunity, and get maximum profits.

All you need is to win over a large sample of many executions… and you will achieve your long-term financial goals via the stock market.

To summarize:

Consistency is a mental skill that’s a part of your mindset. And your mindset represents 90% of your investing edge. (This doesn’t only apply to investing. The top sportsmen also know they can never be perfect, but they work damn hard at improving their consistency.)

The other 10% is your method. As I’ve mentioned earlier, if your system and process don’t stack the odds in your favor…

Consistency won’t get you much in compound returns.

That’s why you must first put a method in place and then use it to hone your consistency mindset (which takes lots of time and effort).

And mastering the next skill helps you do just that.

Skill #2: Planning Sets The Path To Your Investing Goals

It’s obvious you need to make a plan for many different scenarios if you want to skyrocket the chances of achieving any goal.

Virtually all investors recognize they need a plan. Yet nary a few actually make one.

That’s because creating an actionable plan takes time, effort, research, and analyzing your underlying motivations & objectives.

Now, if you manage to do it, you not only make building a consistency mindset easier (by deciding in advance how to deal with various future situations)…

But also solve the 2 biggest problems investors face:

- Not getting enough in returns to fund a 22-30 year retirement.

- Experiencing large portfolio value falls during bear markets.

To solve these problems successfully, your investment plan must have these 4 sections:

- The Why – Your Purpose

Here you state your purpose for taking full control of your investing. That’s usually solving the two problems from above.

- The What — Your Goals And Objectives Statement.

Make sure this section is aligned with your why. Also, put down specific returns.

And list out exactly how much money you can risk and the effort you want to put into investing.

- The How — Your Method

A very difficult thing to do effectively because, as I’ve mentioned, your entire edge depends on how well-founded your method is.

In this step, you define timing (Buy, Sell, Hold, Rebalance criteria & rules)

You also define risk and money management rules.

Again, if you don’t define these in line with your “What” and if they’re not based on proper research…

Results won’t come even if you’re mindset is spot on.

- The Process — Your Routine And Tasks

Go into detail about your daily/weekly routines — define exactly what you will do and when. Even if the task seems basic (e.g., check your investment app) — list it out.

It would take me a lot more space to explain exactly how you should create your Investment Plan (that’s why I have a separate course for it). What you must know is you need one if you want to reap all the benefits of a systemized investing process.

But even if your plan is perfect, it won’t mean much without the following skill:

Skill #3: Be Methodical And Define And Apply Your Method No Matter What

Now it all boils down to actually doing everything you planned. Without hesitation or doubt.

This is where your method comes in. When you create one that tells you exactly which stocks to buy, when to buy, how much to buy, and when to sell…

You must follow it to the letter.

In other words, your method is a DSS (Decision Support System) that guides your every move in the market.

And unless you are an investor with decades of experience, your best bet is creating or obtaining a mechanical DSS.

That’s because it sets the foundation for building a consistent mindset by helping you pre-determine the rules for everything that can happen in the stock market.

I talk about the advantages of a mechanical DSS all the time, so I won’t go deep into it today. Just know that without a reliable one, you don’t have a systemized investing process.

Even if your mindset is spot on.

It also makes it impossible to reap the benefits of the next skill:

Skill #4: Learn How To Focus And Zero In ONLY On The Right Things

KNOW what to DO, then DO what you KNOW.

You see how everything I talked about so far fits into this sentence?

First you build a method that tells you exactly what to do in various market conditions.

Then you apply it.

So, if you can focus only on obtaining a reliable method and then executing it with consistency…

Without falling prey to external & internal noise and changing course because of individual losses, analysts’ opinions, four primal fears (losing, being wrong, missing out, and leaving money on the table)…

Being a peaceful and profitable investor will be within your grasp.

The key word here is “focus.” And focusing only on the right things (the ones you can control) while excluding everything else is easier said than done.

But you can do it with the help of section 4 of your Investment Plan. Remember, there you go into detail about the daily routines and processes you must go through to reach your investing goal.

Assuming you diligently filled out this section, “all” you need to do is execute each step… and forget about everything else.

And yes, this once again brings us to the importance of having a mindset of consistency. Because without building it, you can’t build focus either.

That’s why the final skill is so crucial. It helps you build both skills faster and sustain them over the long run.

Skill #5: If You Aren’t Coachable, Peaceful Profitability Will Elude You In The Long Run

When I say “coachable,” I don’t mean you have to work directly with mentors, coaches, etc. But you have to be ready to learn.

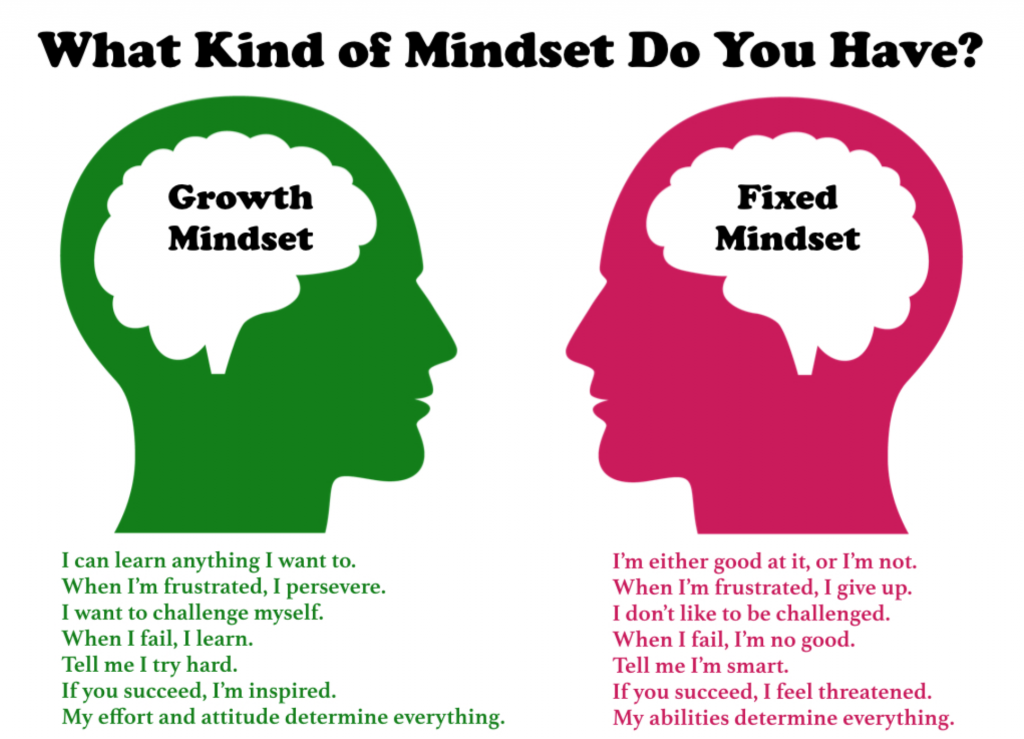

This means being open to feedback and listening to other ways of doing things. And cultivating a growth mindset.

The following image shows exactly what I’m talking about:

The end goal is creating/finding a reliable method and challenging your current market beliefs…

Thereby making an opening for embracing the mindset of consistency. Then you continuously strive to become a better version of your investing self while improving both your Method and Mindset.

In my experience, a great coach with relevant expertise can help you achieve this end goal much faster. And then help you sustain it over the long run. Plus, help you build every other skill I talked about today (and more).

But having one isn’t a must. If you prefer to tread your own path — do that. Just have a clear goal in mind and be realistic with yourself as to whether or not you can reach it without help.

How Do These 5 Skills Tie Back To A Systemized Investing Process And Being A Profitable And Peaceful Investor

If you’ve read through my long ramblings so far, you understand being a profitable and peaceful investor is the product of 2 things:

Method + Mindset

And a systemized investing process is comprised of exactly those two things:

A reliable and verified DSS with a pre-researched edge…

And a mindset of consistency that helps you execute the DSS and profit from the edge…

Without fear, hesitation, or spending much time on your investment decisions once you define your game plan.

In fact, if you find a reliable DSS (instead of creating one from scratch) and have someone to keep you accountable for executing it…

There’s not much left for you to do other than trust your investing system and guides while building the above skills.

Which not only helps you fund your long-term financial goals from the stock market…

But also leaves ample time for you to enjoy life without stressing out about your investing decisions.

That’s what a systemized investing process can do for you. And is exactly what our process has done for one of SWS’s Systemized Investing Program’s members, whose message inspired this article.

So, I think it’s fitting to close with it:

“SWS has eliminated my constant worrying about what shares to buy and more importantly when to sell, I let the system do it’s thing so I can live life.”