Today I’m going to share a quick story about an investor named James, who we spoke with a little while back.

It is a bit of a long one, so if you’d prefer to watch the video, you can do so here:

James previously worked for a company called Whitehaven Coal, that you might have heard of.

His story is not unique, but it’s a really good example of why you can make much more money in the market by using timing rather than just buying, holding and hoping things work out well.

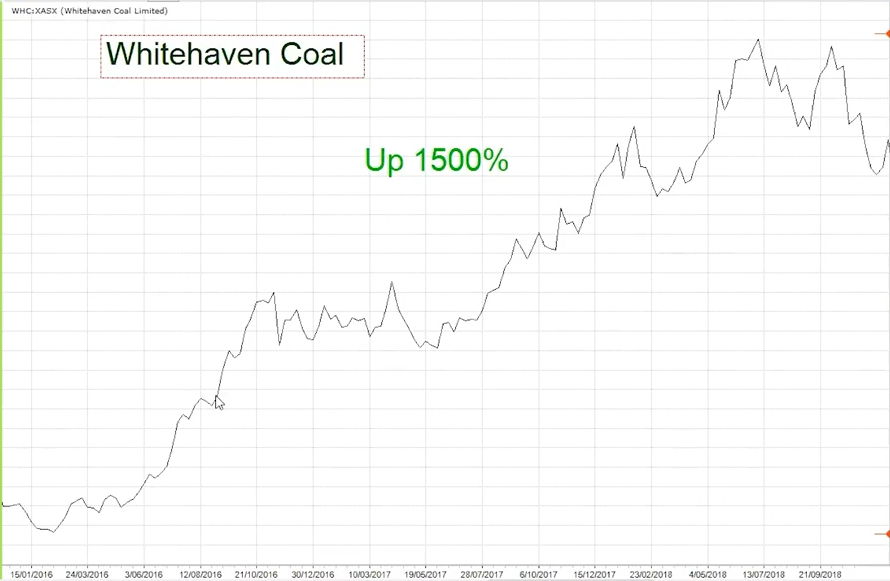

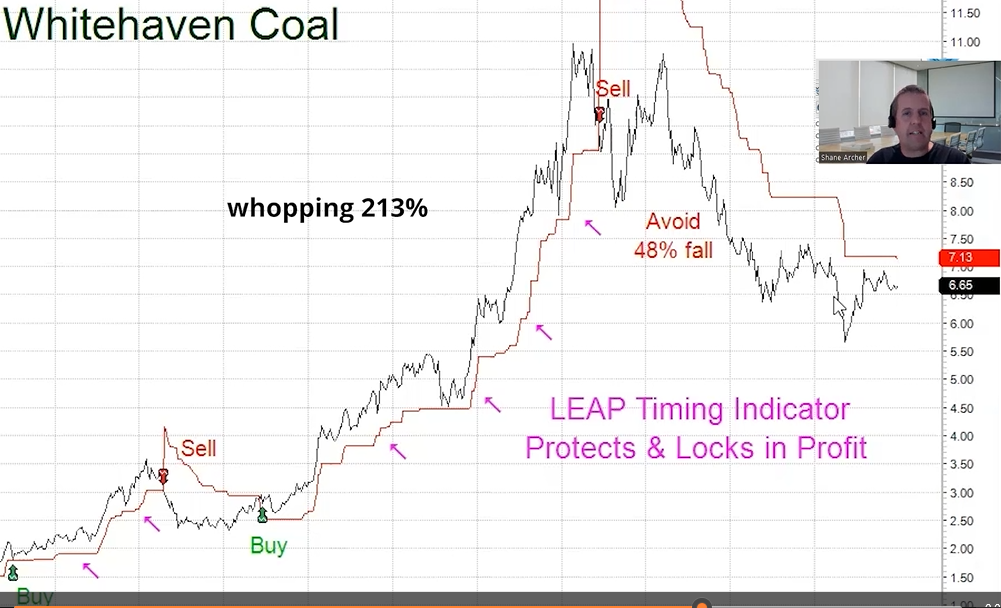

As you can see on the chart below, Whitehaven Coal has big trends up, and big trends down.

And while you would have made some money had you bought at the green arrow and held on until today…

You’d be a lot better off had you used timing to take advantage of the uptrends, whilst missing most of the downtrends.

Now that’s obviously a lot easier said than done. But stick with me on this one to see where it takes us.

Let’s start by zooming in on a few specific time frames while I tell you about James.

You see in 2016, 2017, and 2018, Whitehaven Coal went on a huge run and James had purchased a bunch of shares on the way up as it rose almost exponentially.

You can see that on the chart here…

It grew 1500% in only a few years and James was killing it. He couldn’t believe his luck.

But the problem was, he didn’t have anything to tell him when to get out.

He thought that he’d instinctively know when to sell and retire on his massive profit.

So, when things started to get uncertain (as you can see towards the end of the chart), he just held on, thinking they’d still have plenty of room to grow.

Now, we’ve all done that, haven’t we?

We let that little voice in our head tell us to keep holding on even though we know we should sell.

It’s these sorts of mistakes that cost us dearly as investors and can even lead to ruin.

Unfortunately, that’s what happened to James too.

Whitehaven got smashed over the next two years and he gave back nearly all his profit.

At the time, the entire world was talking about emissions targets, the government was pumping stacks of money into renewables and the price took a dive.

Coal was dead in the water and the Whitehaven stock price had paid the ultimate price for it…

Taking James, and his hopes of an early retirement down with it.

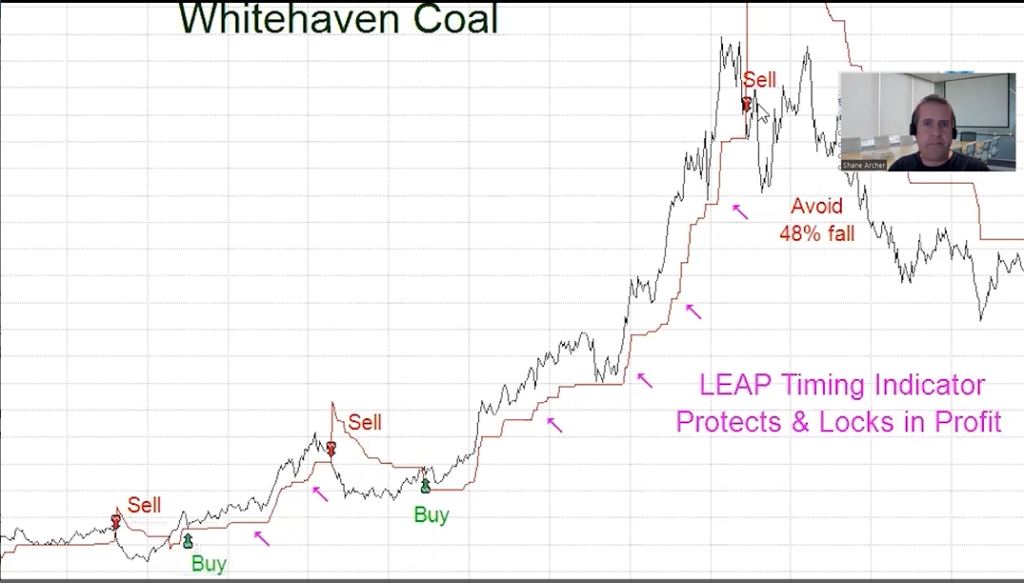

So, when we showed him this chart…

And the exit signal that SPA3 Investor had at the time, he almost cried realizing how much he would have saved had he gotten out when he saw things beginning to turn south.

This is why timing is so critical.

By missing the biggest down days in the market you massively increase your chances of achieving your long-term profit goals.

Now, do you know the story of Whitehaven Coal and what’s happened since?

Well I’m going to tell you anyway.

Basically, when everybody had written them off and no one was going to invest in coal ever again, the share price started to turn.

If you’d looked at the fundamentals or listened to all the doom and gloom surrounding Whitehaven in the media, I’m betting there’s not a chance you would’ve thought to invest in them again.

Yet for some reason, people were buying.

The tide was changing and the price had started to rise.

And because of that, our SPA3 Investor system gave an unemotional, objective, buy signal.

That’s the great thing with a mechanical system. It’s completely objective.

There’s no emotion.

No second-guessing.

No time consuming and complex analysis (that was all done years ago).

Just pure execution of a clear as day call to action on when to enter or exit your stock position.

You can see that clearly here…

Three buy signals and three sell signals as Whitehaven rallied over the next 2 years.

The first trade didn’t really do much.

But we got out and protected when the price started to dip.

We didn’t know what was going to happen next. Nobody does.

But if the uptrend doesn’t continue and the stock price falls 85% like it did in the past, you don’t want to be there kicking yourself like James did, do you?

That’s why, when your system tells you to sell, you sell.

You don’t leave it to chance and hope things work out for the best.

The second trade was a tidy 51% profit, before the price started to pull back and we sold again, locking-in our profit.

Again, we don’t know what’s going to happen next…

We simply follow the pre-researched calls to action our system generates and don’t leave it to chance.

In this case, the trend reversal wasn’t too bad and the share price started to rise a couple of months later, leading to our third buying opportunity…

As you can see with this third trade, we actually managed to get back in at a better price than our previous sell, and went on to make a whopping 213% profit.

Not bad for a trade that took zero amount of research or analysis…

And was executed in 5 minutes thanks to the buy alert sent directly to our smartphones.

Once again, when the exit signal occurred, we sold. And we haven’t touched it since.

From it’s peak, just prior to the final sell signal, WHC fell by nearly 50% – from $11.04 to a low of $5.64.

Now when that happens, you don’t want to be locked into that trade, frozen like a deer in the headlights watching your money dwindle away.

So, you take the money out with a decisive exit signal and you put it in the next stock that the system tells you to buy.

And you repeat that process.

Day after day.

Month after month.

Year after year.

Until you reach your destination.

And that’s what it’s all about. Using timing rather than buying, holding and hoping like James did.

Warren Buffet famously said, ‘be greedy when others are fearful and fearful when others are greedy’.

That’s exactly what we’ve done here with Whitehaven Coal.

So don’t leave your money in the hands of others who don’t care nearly as much about it as you do.

Learn the skills for yourself.

Take control of your own financial destiny

And start setting a plan in motion to achieve your long-term financial goals.

Your future self will thank you for it later.

To your success.